FTSE 100 Live 29 May

- Court ruling lifts US futures

- Nvidia results boost shares

- Auto Trader hails AI impact

Market update: Tariff ruling lifts Wall Street, FTSE 100 struggles

10:17 , Graeme EvansA boost for US futures following the shock court ruling on President Trump’s tariffs today failed to translate into another strong session for the FTSE 100 index.

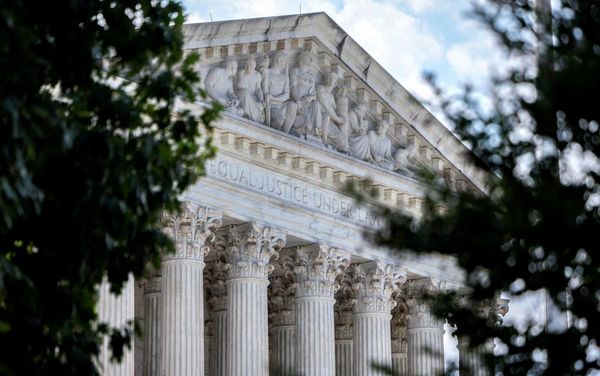

The Court of International Trade said Trump overstepped his authority by imposing across-the-board tariffs on US trading partners.

The ruling, which the White House intends to challenge, boosted the risk appetite of investors amid hopes of a further de-escalation of global trade tensions.

Given that the EU had been facing the imposition of 50% US tariffs from 9 July, the Dax in Frankfurt and Cac40 in Paris reached mid-morning 0.6% and 0.8% higher.

In Asia, the Nikkei 225 index rose 1.9% and the Hang Seng index by 1.4%.

Futures pointed to a rise of 1.6% for the S&P 500 index, with sentiment given a further lift by relief over the latest forecast-beating results of Nvidia.

The chip giant’s share rose 5% in extended hours after chief executive and founder Jensen Huang described global demand for Nvidia’s AI infrastructure as incredibly strong.

The update left Nasdaq futures more than 2% higher, fuelling gains of about 1.5% for Polar Capital Technology Trust and Pershing Square Holdings in London.

AJ Bell investment director Russ Mould said: “For the court to determine that President Trump didn’t have the authority to impose the Liberation Day tariffs is a pretty seismic development.

“That the gains were measured rather than blockbuster reflects a healthy level of scepticism over whether this can truly rein in the Trump administration, which has already launched an appeal against the judgement.

“The problem for investors is it could prolong uncertainty even if, ultimately, it results in a better outcome from a market perspective.

“It also exacerbates the issue of how the big tax cuts being brought forward in the US will be funded – given revenue from tariffs was supposed to help on this front.”

Other risers in London came from the mining and oil sectors after the demand outlook was boosted by the US federal court block.

Brent Crude rose by 1% to $65.63 a barrel and copper futures lifted 0.6%.

Glencore shares responded with a gain of 4.45p to 276.5p and heavily-sold BP recovered 2.9p to 361.1p.

Other risers in the top flight included Asia-focused stocks Standard Chartered and Prudential after gains of 19p to 1159p and 13p to 846.2p respectively.

On the fallers board, a retreat from safe havens and the impact of ex-dividend stocks including National Grid and Marks & Spencer contributed to the underperformance of the FTSE 100 index.

Auto Trader shares surrendered all their gains for this year in the wake of annual results, which showed an 8% rise in operating profit to £376.8 million.

Shares slumped 14% or 127.8p to 772.2p as Peel Hunt said guidance for the current year pointed to a 4% downgrade on the City’s earnings expectations.

The broker, which has a price target of 820p, said the resilient used car market had become a headwind for Auto Trader given the accelerated speed of vehicle sales on its platform.

In the FTSE 250 index, Hollywood Bowl fell back 9% or 26p to 270p after the ten-pin bowling operator said in robust half-year results that recent fine weather has had a short-term impact on trading.

Demand outlook boosts FTSE 100 miners, Auto Trader down 10%

08:45 , Graeme EvansMiners and oil stocks rallied in London today after the demand outlook was boosted by the US federal court block to President Trump’s tariff plans.

Brent Crude rose by a dollar to $65.93 a barrel and copper futures lifted 0.6%.

Glencore shares responded with a gain of 4.75p to 276.8p, Anglo American added 29.5p to 2214p and BP rose 4.6p to 362.8p.

The FTSE 100 index underperformed, compared with gains of more than 0.5% In Frankfurt and Paris.

The top flight was only a handful of points higher at 8732, with Marks & Spencer and National Grid among those lower after their shares were marked ex-dividend.

Auto Trader shares slid 10% or 93p to 807p, wiping out most of their gains for this year.

Richard Hunter, head of markets at Interactive Investor, said: “The challenges to the stock supply have not yet been addressed and in addition, the FCA’s investigation into motor finance practices is something of an overhang on the stock.

“These numbers are middle of the road by the standards Auto Trader has set itself and the shares are being somewhat punished as a result.”

Vehicle production at 70 year low - SMMT

08:22 , Graeme EvansCar and van manufacturing in the UK has slumped to its lowest level in more than 70 years, monthly figures from the Society for Motor Manufacturers and Traders show.

The SMMT said the number of cars made in Britain fell by 8.6% in April while production of vans and other commercial vehicles was down by 68.6%.

Overall UK car and commercial vehicle production fell by 15.8% to 59,203 units in April.

Excluding the first Covid lockdown in 2020 when virtually all manufacturing ceased, this is the lowest output total for the month since April 1952 - a year when the Morris Minor was the best selling car in the UK.

While output was limited by the timing of Easter, model changeovers and temporary plant closures, the figures will nonetheless sound alarm bells.

The SMMT said “urgent action” is required to reboot one of the country’s most important manufacturing and exporting sectors.

Building society Nationwide cheers “outstanding” year

08:15 , Graeme EvansNationwide Building Society has posted a 30% jump in annual profit to £2.3 billion after an “outstanding” year that saw it complete the takeover of Virgin Money.

The improvement came despite it handing out a record £2.8 billion in value to members, including £1 billion in rewards.

On an underlying basis, pre-tax profits fell to £1.85 billion from £2 billion as it said it focused on offering competitive interest rates to customers.

Chief executive Debbie Crosbie said: “Nationwide has had an outstanding twelve months.”

FTSE 100 opens higher, US futures rally on tariffs ruling

08:08 , Graeme EvansGlobal markets have been lifted by the ruling of the US Court of International Trade that President Trump did not have the authority to impose most of the tariffs announced in April.

The FTSE 100 index has opened 37.14 points higher, while S&P 500 index futures are up 1.6% and the dollar index has lifted 0.4%. In Hong Kong, the Hang Seng index is 1.5% higher.

IG Index said the ruling had boosted the risk appetite of investors amid hopes of reduced policy uncertainty.

It added: “The dollar climbed against safe haven currencies, and Treasury yields edged higher as markets reduced odds of a near-term Federal Reserve rate cut amid persistent inflation concerns.”

Nvidia shares rally despite export curbs impact

07:52 , Graeme EvansChip giant Nvidia last night said first quarter revenues of $44.1 billion rose 12% from the previous quarter and by 69% from a year ago.

US curbs on exports of its H20 products into the China market meant Nvidia incurred a $4.5 billion charge in the first quarter due to excess inventory and purchase obligations.

Sales of H20 products were $4.6 billion for the first quarter prior to the export restrictions, with Nvidia unable to ship an additional $2.5 billion of H20 revenue in the period.

Net income for the first quarter of $18.8 billion fell 15% on the previous three months but rose 26% on a year earlier, beating Wall Street expectations.

Shares rose 5% in extended hours dealings as Nvidia also said revenue is expected to be about $45 billion in the current quarter, reflecting a loss in H20 revenue of approximately $8 billion.

Founder and chief executive Jensen Huang said the company’s Blackwell NVL72 AI supercomputer is now in full-scale production across system makers and cloud service providers.

He added: “Global demand for Nvidia’s AI infrastructure is incredibly strong.

“AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate.

“Countries around the world are recognising AI as essential infrastructure — just like electricity and the internet — and Nvidia stands at the centre of this profound transformation.”

Auto Trader hails AI impact, operating profit higher

07:26 , Graeme EvansThe boss of Auto Trader today hailed the impact of data tools and AI-powered products after the car retail platform reported an 8% rise in annual operating profit to £376.8 million.

Nathan Coe said a recently-launched suite of AI-powered products called Co-Driver had delivered “one of the most significant improvements” to the search experience in years.

Coe added: “The first wave of Co-Driver products has already successfully enhanced the quality of adverts, while reducing the amount of time it takes for retailers to advertise their vehicles.

“We see significant potential for the use of AI to improve the buying and selling of cars in the years ahead.”

Revenues rose 5% to £601 million in the year to 31 March. The number of cars advertised on Auto Trader each month is on average 449,000.

Retailer revenue growth in the second half of last year was 5%, which the company expects to accelerate to 5%-7% for the current financial year.

Coe said: “Despite broader macroeconomic uncertainties, the UK car market is in good health and we continue to deliver against our strategy to improve car buying and retailing.”

Global markets rally on Nvidia results and tariff hopes

07:03 , Graeme EvansUS futures are pointing higher after a federal court blocked President Trump’s tariffs plans and Nvidia beat first quarter earnings estimates.

The chip giant’s shares rose 5% in after-hours dealings as the closely-watched results also included robust guidance for the current quarter.

The Nasdaq is seen rising by more than 2%, while the S&P 500 index is set to rally by about 1.7% amid hopes of a de-escalation of global tariff tensions.

IG Index futures show the FTSE 100 index rising by about 0.7% to 8790, having fallen by 0.6% in yesterday’s session.

Asia markets are in positive territory, with the Nikkei 225 up 1.8% and the Hang Seng index 1% stronger.