In the high-stakes world of enterprise AI, C3.ai Inc. (NYSE:AI) has long been the poster child for Microsoft Corp.‘s (NASDAQ:MSFT) Azure ecosystem—a “darling” buoyed by deep integrations and joint go-to-market strategies. But that shine has dulled dramatically with a drop in its momentum score.

Check out AI’s stock price here.

Microsoft's Fabric Push Leaves C3.ai In Momentum Freefall

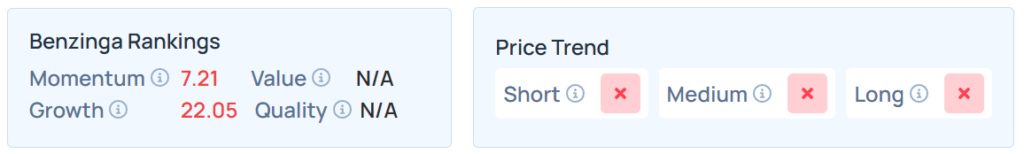

The company’s momentum score has cratered to a dismal 7.21th percentile, ranking it in the bottom percentile of all stocks for price strength across multiple timeframes, according to Benzinga Edge’s Stock Rankings.

This plunge signals acute partner risk, as Microsoft’s aggressive push into proprietary AI tools like Fabric threatens to sideline third-party players like C3.ai.

At the heart of the ‘momentum dog’ status is the Microsoft partnership, once a lifeline. An expanded alliance announced at Microsoft Ignite in November 2024 positioned Azure as C3.ai’s preferred cloud, with joint deals comprising 73% of the fourth-quarter FY2025 agreements.

Yet, Microsoft’s Fabric—an end-to-end analytics platform that grew 55% year-over-year—now integrates AI natively, reducing reliance on external apps like C3.ai’s offerings.

According to a Nasdaq report, analysts note Fabric’s “context layer” for AI could cannibalize partner ecosystems, with C3.ai’s 90% partner-led deals suddenly vulnerable.

See Also: Nvidia Packaging Partner Amkor Logs Momentum Gain— Up Over 30% YTD On AI Surge

C3.ai Drops Over 57% In 2025

The backdrop is grim. C3.ai’s shares have shed 57.23% year-to-date, exacerbated by a Reuters report on Nov. 10 revealing the company’s exploration of a potential sale amid leadership turmoil.

Founder-CEO Thomas Siebel stepped down in September due to health issues, handing the reins to Stephen Ehikian, a Salesforce alum with acquisition experience but unproven in turning around a flagging AI pure-play. –

What Do Other Rankings Say About C3.ai?

In premarket on Thursday, the shares of C3.ai fell by 0.067%. It maintains a weaker price trend over the short, medium, and long terms, with a poor growth ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

https://editorial-assets.benzinga.com/wp-content/uploads/2025/11/13045243/AI-EDGE-NOV-13-300x45.png 300w, https://editorial-assets.benzinga.com/wp-content/uploads/2025/11/13045243/AI-EDGE-NOV-13-768x116.png 768w, https://editorial-assets.benzinga.com/wp-content/uploads/2025/11/13045243/AI-EDGE-NOV-13.png 1156w" sizes="(max-width: 1024px) 100vw, 1024px" />

https://editorial-assets.benzinga.com/wp-content/uploads/2025/11/13045243/AI-EDGE-NOV-13-300x45.png 300w, https://editorial-assets.benzinga.com/wp-content/uploads/2025/11/13045243/AI-EDGE-NOV-13-768x116.png 768w, https://editorial-assets.benzinga.com/wp-content/uploads/2025/11/13045243/AI-EDGE-NOV-13.png 1156w" sizes="(max-width: 1024px) 100vw, 1024px" />Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock