Baidu Inc. (NASDAQ:BIDU) has surged into the upper echelon of potential bargain stocks, triggering a notable shift in its proprietary Benzinga ratings.

Check out BIDU's stock price here.

Google’s China Rival Jumps In Value Ranking

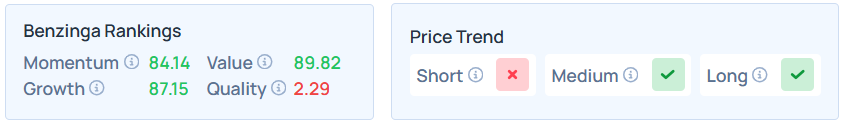

According to the latest Benzinga Edge’s Stock Rankings data, “Chinese Google” saw its value ranking jump from 88.34 to 89.82 week-on-week.

This score places Alphabet Inc.‘s (NASDAQ:GOOG) (NASDAQ:GOOGL) Chinese rival in the top tier of stocks when comparing its current market price to fundamental measures of assets, earnings, and operating performance.

The rankings paint a picture of a company that is statistically undervalued relative to its growth potential. Additional performance details are available here.

Baidu’s Aggressive AI Push Perks Up Growth

While Baidu's short-term price trend is flagged as bearish, the company maintains a robust growth ranking of 87.15. This metric underscores the company’s historical expansion, which is currently being fueled by a massive pivot to artificial intelligence.

In its recent third-quarter earnings, Baidu reported that while core advertising revenue slumped 18%, its AI Cloud revenue skyrocketed by over 50% year-over-year.

Quality Score Aligns With Michael Burry’s Warning

However, the data also reveals why the stock is trading at such a steep discount. While the value and growth scores are elite, Baidu's quality ranking sits at a concerning 2.29.

The quality metric evaluates operational efficiency and financial health, and this near-bottom score aligns with recent warnings from “The Big Short” investor Michael Burry.

Following Baidu’s third-quarter report, Burry criticized the company for accounting maneuvers and a massive $2.2 billion impairment charge, suggesting that previous profit gains were driven by extending the “useful life” of servers rather than operational success.

For investors, the Edge rankings confirm a complex narrative: Baidu is aggressively priced for value and growth, but its low quality score warns that this bargain comes with significant fundamental risks.

Baidu Outperforms Nasdaq In 2025

Shares of BIDU have risen 33.56% year-to-date, whereas the Nasdaq Composite and Nasdaq 100 indices have returned 14.51% and 14.68%, respectively. The stock was 1.34% lower in premarket on Friday.

On Thursday, the shares closed 4.36% lower at $110.45 apiece and rose by 0.36% in after-hours. The stock has gained 35.31% over the year.

The futures of the S&P 500, Nasdaq 100, and Dow Jones indices were trading higher on Friday, after a sharp sell-off on Thursday.

Read Next

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock