As Tesla Inc. (NASDAQ:TSLA) CEO Elon Musk's trillion-dollar pay package received 75% approval from investors during the automaker's shareholder meeting, here's what investors and industry executives had to say.

Check out the current price of TSLA here.

Michael Dell Calls Approval ‘A Decisive Statement'

Taking to the social media platform X on Thursday, Dell Technologies Inc. (NYSE:DELL) founder and CEO Michael Dell congratulated Musk on the approval. "75% is quite a decisive statement" by Tesla investors and shareholders, Dell said in the post.

Ross Gerber Says He Is Excited Amid Stock Dilution Concerns

Meanwhile, investment firm Gerber Kawasaki's co-founder Ross Gerber shared that 2026 could be a crucial year for Tesla. "2026 is the year tesla does everything," Gerber said, adding that he was "excited" to see how the EV giant's plans pan out.

Musk provided a comprehensive overview of the automaker's roadmap during the meeting.

Gerber had earlier expressed concerns about stock dilution if the package were to be approved. He had also called the pay package "insanity" and questioned the Tesla Board's independence from Musk's influence.

Dan Ives, Jim Cramer Also Hail The Package Despite Opposition

In an investor note released on Thursday, Wedbush Securities' managing director, Dan Ives, called Musk Tesla's "biggest asset" and said that the approval has cemented the billionaire in the CEO role for the "foreseeable future."

Ives also reiterated that Tesla must work to achieve the targets laid out in the pay package, including the first milestone of hitting $50 billion adjusted EBITDA (Earnings Before Interest, Taxes, Debts, and Amortization).

It's worth noting that Musk could still pocket billions of dollars under the new pay package even if Tesla fails to accomplish every goal laid out in the compensation award.

Elsewhere, TV host Jim Cramer also took to the social media platform X to share his views. "A deserving Musk gets his package!" Cramer said in the post. He had earlier called for Tesla investors to vote in favor of the package.

The package was approved by investors despite opposition from proxy advisors like Institutional Shareholder Services (ISS) and Glass Lewis, as well as receiving criticism from the California Public Employees' Retirement System (CalPERS) and Norway's Sovereign Wealth Fund NBIM.

Gene Munster Adds His Take, Bernie Sanders Calls It ‘Oligarchy’

Meanwhile, Deepwater Asset Management‘s investor Gene Munster hailed the approval as a “win for Tesla shareholders,” adding that he was expecting the vote “to be much closer” than the 75% approval. He also said that the margin was possible as Musk’s vision spoke to retail as well as “institutional” investors. Munster also said that the package was all about the “long-term vision” for Tesla.

Meanwhile, Sen. Bernie Sanders (I-VT) criticized the package, calling it an “oligarchy,” and doubled down on his earlier criticism of the compensation award. “If you’re Elon Musk, the richest man alive, Tesla gives you a $1 trillion pay package & Trump gives you a huge tax break,” Sanders said, adding that the Trump administration would appeal a court decision to provide SNAP benefits “if you’re a poor kid.”

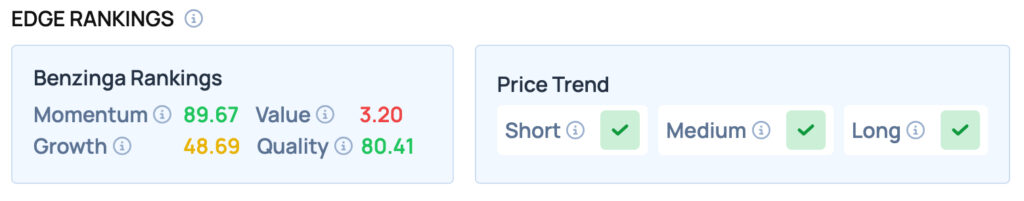

Tesla scores well on Momentum and Quality metrics, while offering satisfactory Growth, but poor Value. Tesla also has a favorable price trend in the Short, Medium, and Long term. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Image via Shutterstock