Dow Jones futures will open Sunday evening, along with S&P 500 futures and Nasdaq futures. Nvidia looms this week, with Trump tariff updates also key.

The stock market rally suffered significant losses last week as Treasury yields spiked. But the S&P 500 index held key support and cut Friday losses despite President Donald Trump's tariff threats vs. Apple and the European Union.

Nvidia earnings and guidance Wednesday night will be key for the artificial intelligence sector and the overall market. Nvidia stock has a new buy point, along with AI chip peers Broadcom and Taiwan Semiconductor Manufacturing.

Tesla has forged a new aggressive entry.

Dow Jones Futures Today

Dow Jones futures open at 6 p.m. ET on Sunday, along with S&P 500 futures and Nasdaq 100 futures.

The U.S. stock market will be closed Monday for Memorial Day, but Dow futures and other exchanges around the world will trade normally.

Remember that overnight action in Dow futures and elsewhere doesn't necessarily translate into actual trading in the next regular stock market session.

Join IBD experts as they analyze leading stocks and the market on IBD Live

Stock Market Rally

The stock market rally suffered big weekly losses, but showed some resilience Friday. The major indexes reversed lower Wednesday on spiking Treasury yields.

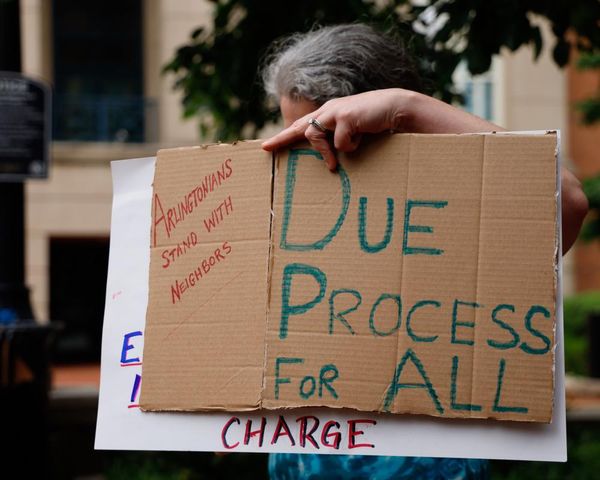

On Friday, President Trump threatened a 25% tariff on Apple if it didn't make the iPhone in the U.S. He later added that Samsung and other handset makers face the same fate by the end of June. He also said he would hike EU tariffs to 50% on June 1, citing a lack of progress in trade talks.

The major indexes fell sharply Friday morning, but pared losses.

The Dow Jones Industrial Average lost 2.5% in last week's stock market trading. The S&P 500 index gave up 2.6%. The Nasdaq composite retreated 2.5%. The small-cap Russell 2000 tumbled 3.5%.

The Dow Jones fell below its 200-day moving average. So did the Invesco S&P 500 Equal Weight ETF, which sank 3.1%.

The S&P 500 tested that key level Friday but closed above it.

Leading stocks fared relatively well. Many, such as Nvidia and Tesla, have forged buy points. Some flashed buy signals, including on Friday.

The 10-year Treasury yield rose seven basis points to 4.51% after hitting a three-month high of 4.63% Thursday morning. Wednesday's weak 20-year Treasury auction, days after Moody's stripped the U.S. government of its final top credit rating, triggered the bond sell-off. Yields fell modestly Friday amid Trump's tariff threats.

U.S. crude oil futures fell 0.7% to $61.53 a barrel last week.

The stock market took Trump's Apple and EU tariff threats well Friday. Many investors see them as a negotiating ploy.

Growth ETFs

The Innovator IBD 50 ETF rose 1.1%, a seventh straight weekly gain. The iShares Expanded Tech-Software Sector ETF fell 3.1%. The VanEck Vectors Semiconductor ETF slumped 3.6%. Nvidia stock is the No. 1 SMH holding. Broadcom and Taiwan Semiconductor stock are also huge members.

ARK Innovation ETF tumbled 4% last week. Tesla stock remains the No. 1 holding across ARK Invest's ETFs.

Time The Market With IBD's ETF Market Strategy

Nvidia Earnings, AI Chip Stocks

Nvidia earnings growth is expected to slow amid tougher comparisons. Investors are looking for guidance on AI demand as well as whether Nvidia production snags are in the past. Nvidia will start production of a new, lower-level AI chip for the China market in June, Reuters reported Saturday, after the Trump administration blocked exports of the H20 processor earlier this year.

Nvidia stock fell 3% to 131.29 last week. That gives NVDA stock a 137.40 handle buy point on a weekly chart.

Broadcom stock edged up 11 cents to 228.72, but now has a 235.28 handle buy point on a daily chart. The Nvidia rival briefly topped that Wednesday morning. Nvidia earnings will surely move AVGO stock, with Broadcom due the following week. Broadcom stock is on the IBD Big Cap 20.

Taiwan Semiconductor stock fell 1.1% to 192.04. On a daily chart, TSM stock has a 196.22 cup-with-handle buy point. On a weekly chart, the handle buy point is 196.83, according to MarketSurge. Taiwan Semiconductor makes chips for Nvidia, Broadcom, Apple and more.

Trump's Apple and Samsung tariff threat raises the prospect of a broader 25% sector tariff on chips and other electronics could be coming soon, after being put to the side.

Why This IBD Tool Simplifies The Search For Top Stocks

Tesla Stock

Tesla fell 3% to 339.34 for the week. Shares now have a 354.99 buy point from a handle that's too low to be valid.

CEO Elon Musk on Tuesday pledged to stay at Tesla through 2030 and gave more details about the upcoming, limited robotaxi launch in Austin next month. The Trump tax bill would eliminate the $7,500 tax credit as well as other key breaks for Tesla.

But investors are clearly pinning their hopes on Tesla self-driving bets.

Tesla Sets Up New Buy Point While Archrival Runs To Record High

What To Do Now

The stock market rally suffered sharp weekly losses after a big run-up. This could be constructive, but it wouldn't take much for the S&P 500 and the Nasdaq to break below their 200-day lines.

So investors should build up their watchlists but have their exit strategies ready.

Investors are on Trump tariff watch again. Nvidia earnings Wednesday night loom large. On Friday, the Fed's favorite inflation report, the core PCE price index, will be released.

Read The Big Picture every day to stay in sync with the market direction and leading stocks and sectors.

Please follow Ed Carson on Threads at @edcarson1971 and X/Twitter at @IBD_ECarson for stock market updates and more.