ASML Holding NV (NASDAQ:ASML) CEO Christophe Fouquet stated on Sunday that the ongoing tensions between the Netherlands and China have not impacted the Dutch chip-gear manufacturer.

Nexperia Saga Won’t Affect ASML In Short Term

The conflict arose following the Dutch government’s takeover of chipmaker Nexperia. Fouquet assured that “it will not affect our business in the short term” during a Dutch television interview, Reuters reported.

The standoff between Nexperia’s European operations and its Chinese facility began after the Dutch seized the company over concerns about technology transfer. This has disrupted the supply of chips essential for the global automotive industry. Fouquet stressed the need for communication, saying the parties should talk before things escalate, and that this time it may have happened in reverse.

West Worried About China’s Expanding Powers

Further discussions are anticipated as a Dutch delegation plans to visit China next week to address the situation. The CEO remains optimistic, suggesting that the worst of the crisis may have passed.

The backdrop of these tensions is the growing apprehension in the West about China’s influence over critical technologies. The Dutch government’s seizure of Nexperia is a significant move reflecting the West’s concern over China’s expanding technological reach. This action is part of a broader trend of Western countries taking measures to limit China’s access to advanced technologies.

ASML’s China Role Has Attracted Scrutiny

Despite these geopolitical challenges, ASML remains committed to its operations in China. According to a recent report, the company has reiterated its dedication to the Chinese market, driven by the booming demand for chips fueled by artificial intelligence advancements. This commitment underscores the importance of China in ASML’s global strategy.

However, the company has faced scrutiny from U.S. lawmakers. Concerns were raised about ASML’s role in enhancing China’s semiconductor capabilities, leading to potential new export restrictions. This scrutiny reflects the complex geopolitical landscape that ASML navigates as it balances its business interests with regulatory compliance.

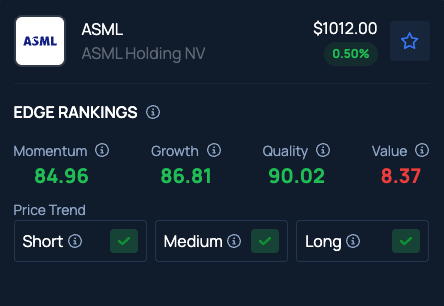

Benzinga's Edge Stock Rankings indicate ASML stock has a Value in the 8th percentile. Here is how it ranks against other chip-sector stocks like Nvidia.

Photo by Skorzewiak via Shutterstock

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal