Prominent analysts are weighing in on Advanced Micro Devices Inc.’s (NASDAQ:AMD) analyst day on Tuesday, during which the company made bold projections regarding its near-term future and that of the broader AI chip and data center industry.

The Markets Are Already ‘Pricing This In’

Analyst Patrick Moorhead of Moor Insights & Strategy called attention to what he described as AMD's “money slides,” pointing to an “aggressive long-term financial model,” on Tuesday, in a post on X.

According to Moorhead, the most significant figure showcased by the company during the event was its earnings target of $20 per share by 2030, which marks a 534% jump from its 2025 projected earnings per share of $3.14. “It’s at the very top of even the most bullish analyst projections.”

He added that getting there “requires AMD to deliver on everything,” from securing double-digit GPU market share and hitting $55 billion to $65 billion in annual GPU sales to successfully executing on its MI450 and Helios accelerators expected in late 2026.

Moorhead also said that with the stock now trading at 60 times its forward earnings, “the market was already pricing this in,” meaning there was limited upside for the stock, despite these bold new targets.

Well Above The ‘Most Bullish’ Wall Street Estimates

The Chief Market Strategist at Futurum Equities, Shay Boloor, said that the company’s earnings forecast was “well above even the most bullish Wall Street estimates.”

Earlier this week, Bank of America analysts had forecasted an earnings per share of $18 by 2030, which was more than five times its forecasted EPS for 2025, but the figure still fell short of the company’s own estimates at $20 per share, driven by strong AI demand and meaningful margin expansion.

Boloor highlighted several other assumptions that were “baked into” reaching this target, such as the 35% in compounded annual growth rate, gross margins at 57%, operating margins at 35% and free cash flow margins at 25%.

All this, alongside a double-digit market share in the global GPU industry, and $60 billion in annual revenue coming just from data centers.

Sector Models Are Too Reliant On Hyperscaler Capex

Fund manager Rihard Jarc struck a more cautious tone, warning that much of the modeling for the semiconductor sector, comprising companies such as AMD and NVIDIA Corp. (NASDAQ:NVDA), was reliant on the capex projections and letters of intent signed by the hyperscalers.

Jarc is concerned that there isn’t sufficient attention being given to “the revenue and profit side of the end-customers who are paying these cloud AI workload bills.”

He warned investors that if these multi-billion-dollar AI buildout commitments get extended or slowed, “valuations will reset to meet that new real trajectory.”

AMD Shares Soar After Hours

Shares of AMD were down 2.65% on Tuesday, closing at $237.52, but are up 6.06% overnight, following the company’s Financial Analyst Day event in the evening.

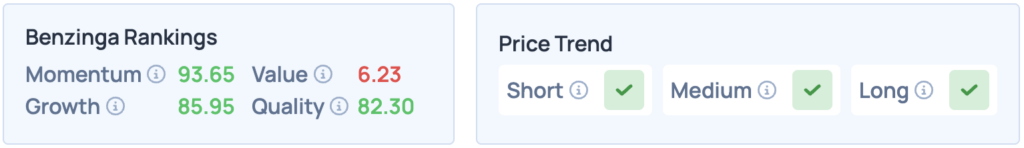

The stock scores high on Momentum, Growth and Quality in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo: Piotr Swat / Shutterstock