Alphabet Inc (NASDAQ:GOOG) (NASDAQ:GOOGL) shares surged to new all-time highs Wednesday morning, driven by the unveiling of its most intelligent AI model, Gemini 3. Here’s what investors need to know.

- GOOG shares are testing new highs. Stay ahead of the curve here.

What To Know: CEO Sundar Pichai positioned the new system as a major leap forward, featuring advanced “agentic + vibe coding” capabilities designed to grasp user intent with significantly “less prompting”.

The model, which supports complex multimodal tasks, begins rolling out Tuesday to select paid subscribers. This technological milestone arrives alongside a massive vote of confidence from legendary investor Warren Buffett. Berkshire Hathaway recently disclosed a new multi-billion stake in the tech giant, fueling further momentum.

While Google DeepMind expands its footprint in Singapore to accelerate real-world AI application, analysts like Bank of America's Haim Israel caution that the industry's explosive growth risks outpacing global infrastructure.

What Else: Nvidia is preparing to release its third-quarter earnings after the bell today, a critical event with potentially massive market cap swings that analysts say could either recharge the AI rally or accelerate a tech sector pullback.

Alphabet investors should monitor the results closely as they serve as a bellwether for the sustainability of AI capital spending; a disappointment could sour the broader market sentiment that has supported this year’s surge in major tech stocks.

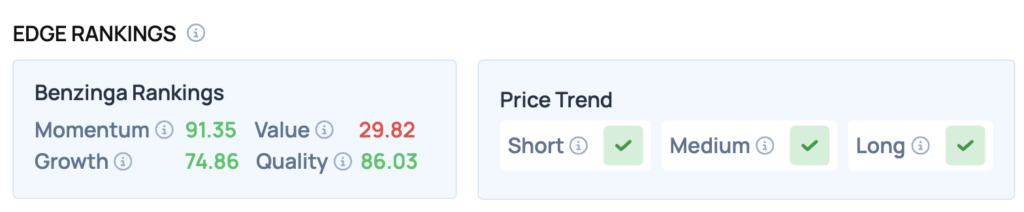

Benzinga Edge Rankings: Benzinga Edge Rankings underscore this bullish activity, assigning Alphabet a Momentum score of 91.35 while confirming positive price trends across short, medium and long-term horizons.

GOOG Price Action: Alphabet shares were up 5.09% at $299.42 at the time of publication on Wednesday. The stock is trading at a new 52-week high, according to Benzinga Pro data.

Read Also: Target Hit By Traffic, Profit Decline Heading Into Holiday Season

How To Buy GOOG Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Alphabet’s case, it is in the Communication Services sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock