Alphabet Inc (NASDAQ:GOOG) (NASDAQ:GOOGL) spent most of the past two years in the market's penalty box. Today, it's the comeback kid propelling hedge fund P&Ls into the stratosphere. When news broke Friday night that Warren Buffett's Berkshire Hathaway Inc (NYSE:BRK) (NYSE:BRK) had taken a $4.3 billion position in Alphabet, the stock jumped 3% on Monday — but the real winners were the managers who were already sitting on Google long before Buffett walked in.

- Track GOOG stock here.

Ackman Has Made Nearly $700 Million In Just Four Months

Pershing Square Capital held 6.32 million Alphabet shares heading into the third quarter. Back on June 30, Google traded at $177.39. With Monday's price at $285.60, Ackman's position has swelled by about $108.21 per share, delivering a staggering $684 million in gains in less than five months.

For a man known for big, bold bets, the quietest one in his book is now one of the most lucrative. Google did the rallying; Bill Ackman just had the patience.

Read Also: Sundar Pichai Says Google’s ‘Universal Search’ Moment Is Coming Again — This Time, It’s AI

Asness Isn't Far Behind — Another $424 Million In The Bag

AQR Capital's Cliff Asness also rode Google's AI-driven renaissance. His 3.92 million Alphabet shares have appreciated by $108.21 per share, translating into roughly $424 million in mark-to-market profits since June.

For a quant who lives in the world of factor spreads and t-stats, Google has become a beautifully simple trade: stay long and watch the fundamentals catch up to reality.

Buffett's Entry Is Big — But Late

Berkshire's 17.85 million new shares at roughly $209.67 may age well, but Buffett missed the most explosive stretch.

Alphabet is now up 50% year to date, outperforming every megacap peer as investors finally acknowledge Google's AI readiness — from TPU momentum to Cloud reacceleration to the impending Gemini 3 reveal.

Why It Matters To Investors

Buffett's endorsement adds prestige, but the steepest gains have already been harvested. While the market obsessed over OpenAI drama, Alphabet quietly assembled the full AI stack — chips, models, cloud, devices — and the early believers are already counting billion-dollar receipts.

Read Next:

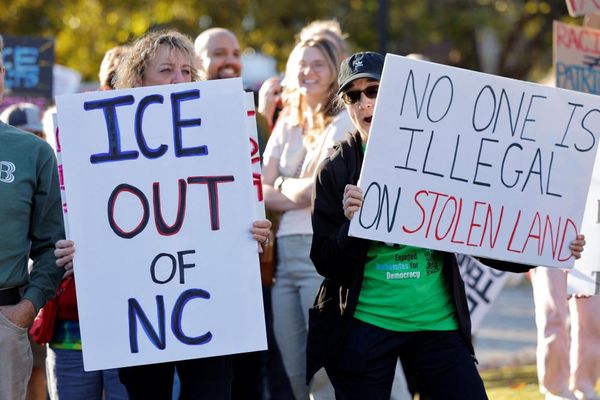

Photo: Shutterstock