A 254 billion-rand ($14 billion) state bailout for South Africa’s cash-strapped power utility will help steady its finances, but won’t immediately improve its operations or alleviate an electricity shortfall that’s crippling the economy.

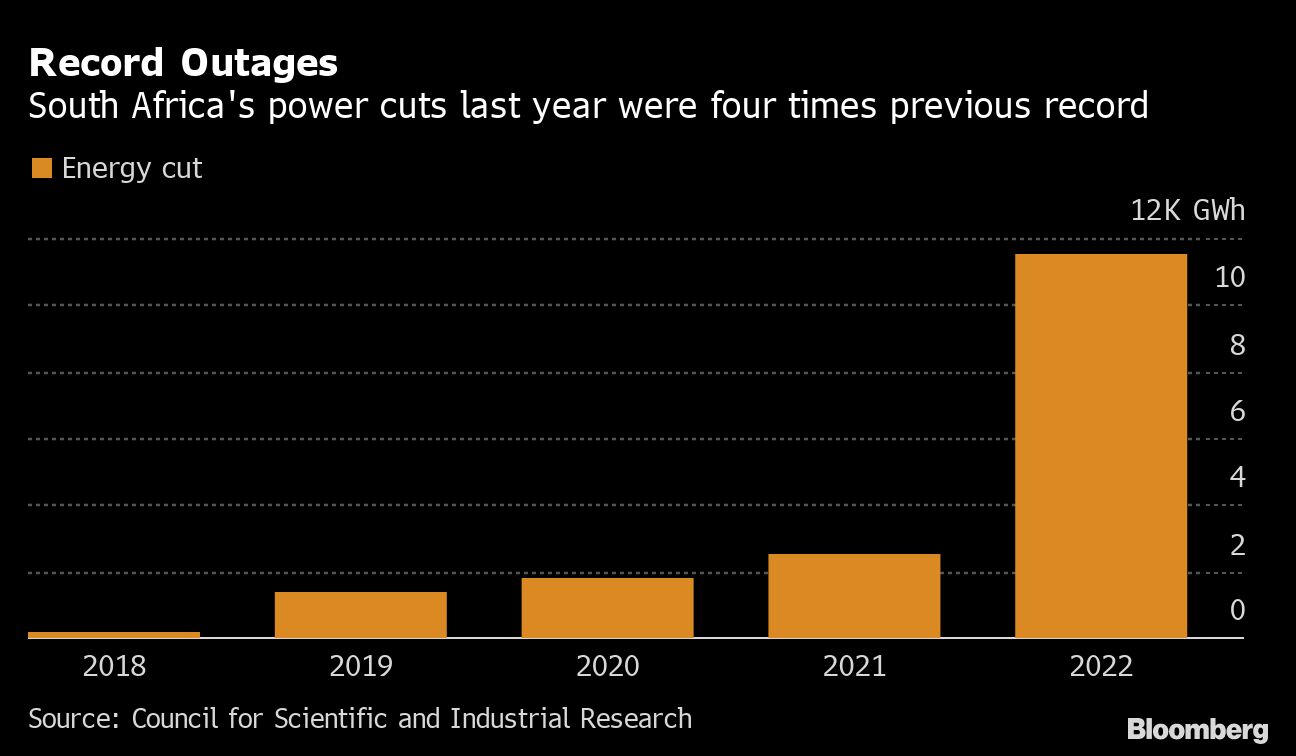

The three-year debt-relief plan for Eskom Holdings SOC Ltd., announced in Finance Minister Enoch Godongwana’s budget speech on Wednesday, is contingent on the company bringing in private operators to help run its plants and transmission network and meeting other performance criteria. Those measures will take months or even years to bear fruit, with the National Treasury warning that rolling blackouts that began in 2008 will persist until at least the end of 2024.

The extent of the energy crisis was on stark display on Tuesday, with Eskom cutting a record 7,000 megawatts of capacity from the national grid to prevent its collapse — the 115th straight day it has instituted outages. The following evening, the utility said Chief Executive Officer Andre de Ruyter would leave his post immediately, rather than at the end of next month as previously planned. The announcement came shortly after he criticized the government and the ruling African National Congress over corruption.

Power shortages will only gradually ease as Eskom’s near-monopoly dwindles and companies and households install more of their own generation capacity, said Lumkile Mondi, an economics lecturer at Johannesburg’s University of the Witwatersrand.

“South Africa as an investor destination, forget it,” he said. “We’re in this period of slow growth for many, many years to come.”

There are manifold reasons for Eskom’s decline, including delays in securing government go-ahead to add new capacity, massive cost overruns at two new coal-fired plants, continuous management upheaval and political interference in its operations.

A lack of funds and spare capacity also forced the utility to scale back on maintenance, which has exacerbated plant breakdowns and outages. And it has fallen victim to theft and graft, with De Ruyter estimating that 1 billion rand is being stolen from its coffers each month, often by people affiliated with the ANC.

Responding to De Ruyter’s allegations, ANC Secretary-General Fikile Mbalula said the party’s lawyers would write to the former CEO demanding that he prove or retract his allegations. He also accused De Ruyter of failing to get a handle on the nation’s energy crisis.

On Feb. 9, President Cyril Ramaphosa announced plans to name an electricity minister to spearhead the response to the blackouts, but an appointment has yet to be made. The government also hasn’t clarified whether Eskom will continue to answer to the public enterprises ministry or be shifted to the energy ministry — a move the ANC has approved but which Godongwana says will complicate the disbursement of debt relief.

Ramaphosa is still considering those matters, along with making changes to his cabinet, said Mbalula.

“He is not a fanatic of doing things just for the sake of doing it and for populist stances,” Mbalula said. “He doesn’t take quick decisions, he applies his mind and when he takes decisions you can be confident in those decisions.”

While cabinet appointments are the president’s prerogative, Eskom’s board should have moved with greater haste to find a replacement for De Ruyter, who announced his intention to quit in mid-December after three years on the job, according to Godongwana. The board will meanwhile have to ensure the utility meets all its obligations to qualify for the debt relief, and if it doesn’t “heads will have to roll,” he said.

Public Enterprises Minister Pravin Gordhan on Thursday said the appointment of an acting CEO is being finalized, and an announcement will be made in due course to ensure there isn’t a leadership vacuum.

Some Eskom investors are giving the government the benefit of the doubt for now, with the yield on the utility unsecured 2028 notes dropping 90 basis points since Tuesday.

“While there is some execution risk, we believe it seems to be a credible plan that — if executed with ruthless focus and urgency — can provide Eskom with a path to return to financial and operational sustainability,” said Olga Constantatos, head of credit at Cape Town-based Futuregrowth Asset Management, which oversees about $11.3 billion in fixed-income investments. The budget documents indicate there is government recognition that “a different approach is needed, which we view as positive,” she said.

--With assistance from Colleen Goko.

©2023 Bloomberg L.P.