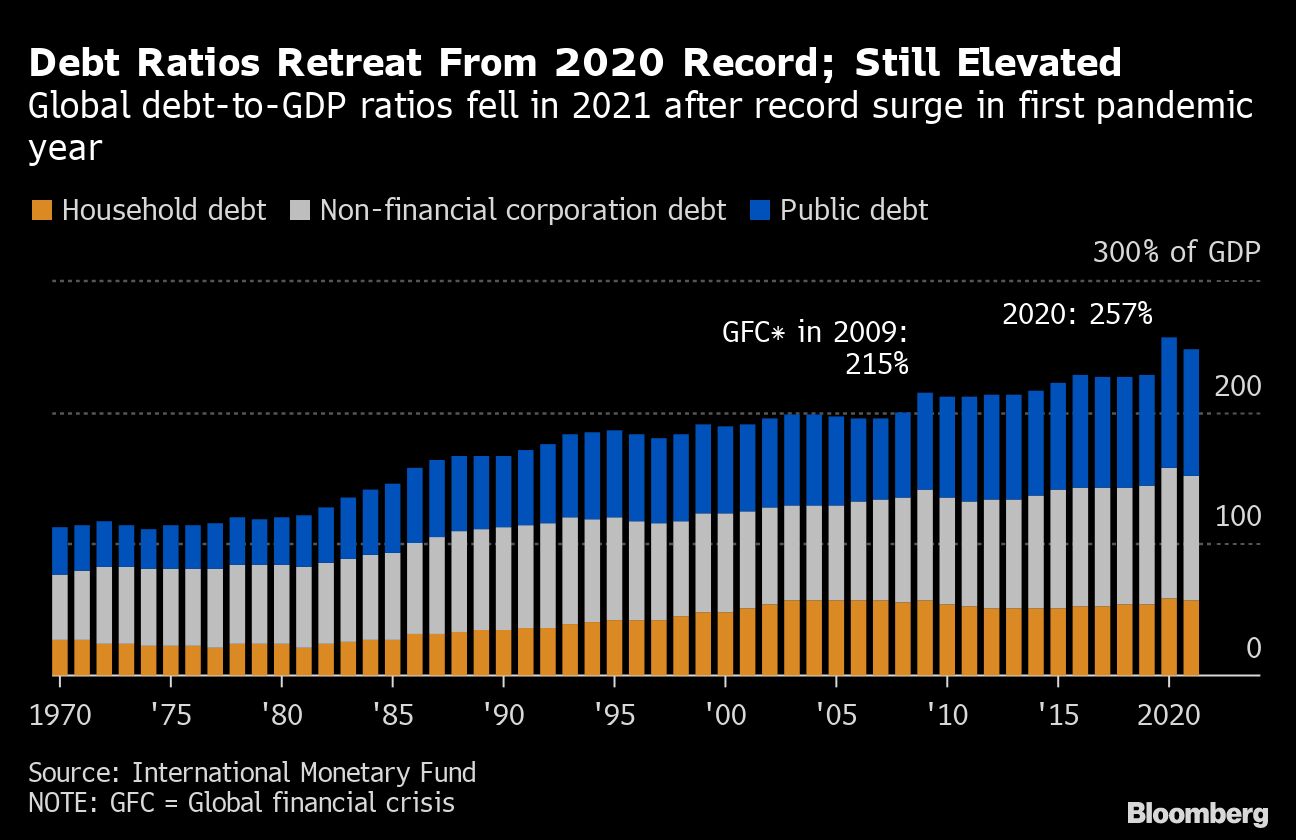

Debt as a share of gross domestic product plunged by the most in seven decades in 2021, but policymakers still face challenges because borrowing remains above pre-Covid-19 levels, the International Monetary Fund said.

While total public and private debt hit a record $235 trillion last year, it plummeted when expressed as a percentage of economic output, which rebounded last year after the steep Covid-19 recession of 2020, the fund said Monday in a blog accompanying the latest update of its Global Debt Database.

Total debt fell to 247% of global gross domestic product last year, IMF data showed. That’s 10 percentage points less than in 2020, but is still the second-highest reading in history.

The data show how many countries are still reeling from the consequences of the pandemic: debt shot up in 2020 because of the economic recession, and so did deficits as governments extended financial help to individuals and businesses. As economies opened up, inflation set in as supply couldn’t meet demand, while food and energy costs rose because of war and climate pressures.

The economic rebound of 2021 and heat of inflation pushed debt down by more than 10 percentage points of GDP in Brazil, Canada, India and the US — but actual debt fell less, owing to the financing needs of government and the private sector, the fund said.

Support from growth is set to fade: IMF calculations show that about one-third of the world economy will have at least two consecutive quarters of contraction this year and next, and that the lost output through 2026 will be $4 trillion.

Surging prices have forced central banks worldwide to tighten monetary policy, and the Federal Reserve’s aggressive stance has strengthened the dollar relative to many currencies.

“Managing the high debt levels will become increasingly difficult if the economic outlook continues to deteriorate and borrowings costs rise further,” Vitor Gaspar, Paulo Medas and Roberto Perrelli, senior officials at the IMF’s fiscal affairs department, said in the blog.

“The weaker growth outlook and tighter monetary policy calls for prudence in managing debt and conducting fiscal policy,” they said.

The drop was most pronounced in advanced economies, with debt falling by 5% of GDP last year, thereby reversing about one-third of the surge seen in 2020, the fund said.

But in low-income developing countries, total debt ratios rose in 2021, driven by private balances outstanding.

Overall global public debt fell 4 percentage points — the biggest retreat in decades — to 96% of GDP, the fund said.

The global tally for private debt — which includes non-financial corporate and household obligations — led the drop, falling by 6 percentage points to 153.5% of GDP, the fund said.

©2022 Bloomberg L.P.