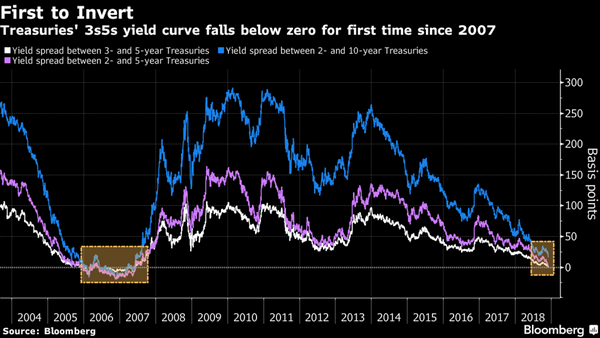

As One Part of Treasury Yield Curve Inverts, Watch Others: Chart

One section of the U.S. Treasuries yield curve just inverted for the first time in more than a decade. The spread between three- and five-year Treasury yields fell below zero on Monday, in what could be the first signal that the market is putting the Federal Reserve on notice that…

Bloomberg