Affirm Holdings Inc (NASDAQ:AFRM) is trading lower Monday after raising guidance, which showed company expectations still remain below analyst estimates.

Affirm said it expects fiscal third-quarter revenue to be at least $335 million, which is up from previous guidance calling for revenue between $325 million and $335 million, but still below the $340.24 million estimate.

The buy now, pay later company also raised full-year guidance from a range of $1.29 billion to $1.31 billion to at least $1.31 billion versus the $1.32 billion estimate.

Related Link: Here's Why Affirm Raised Guidance Today

Truist Securities analyst Andrew Jeffrey maintained Affirm with a Buy rating and lowered the price target from $100 to $55.

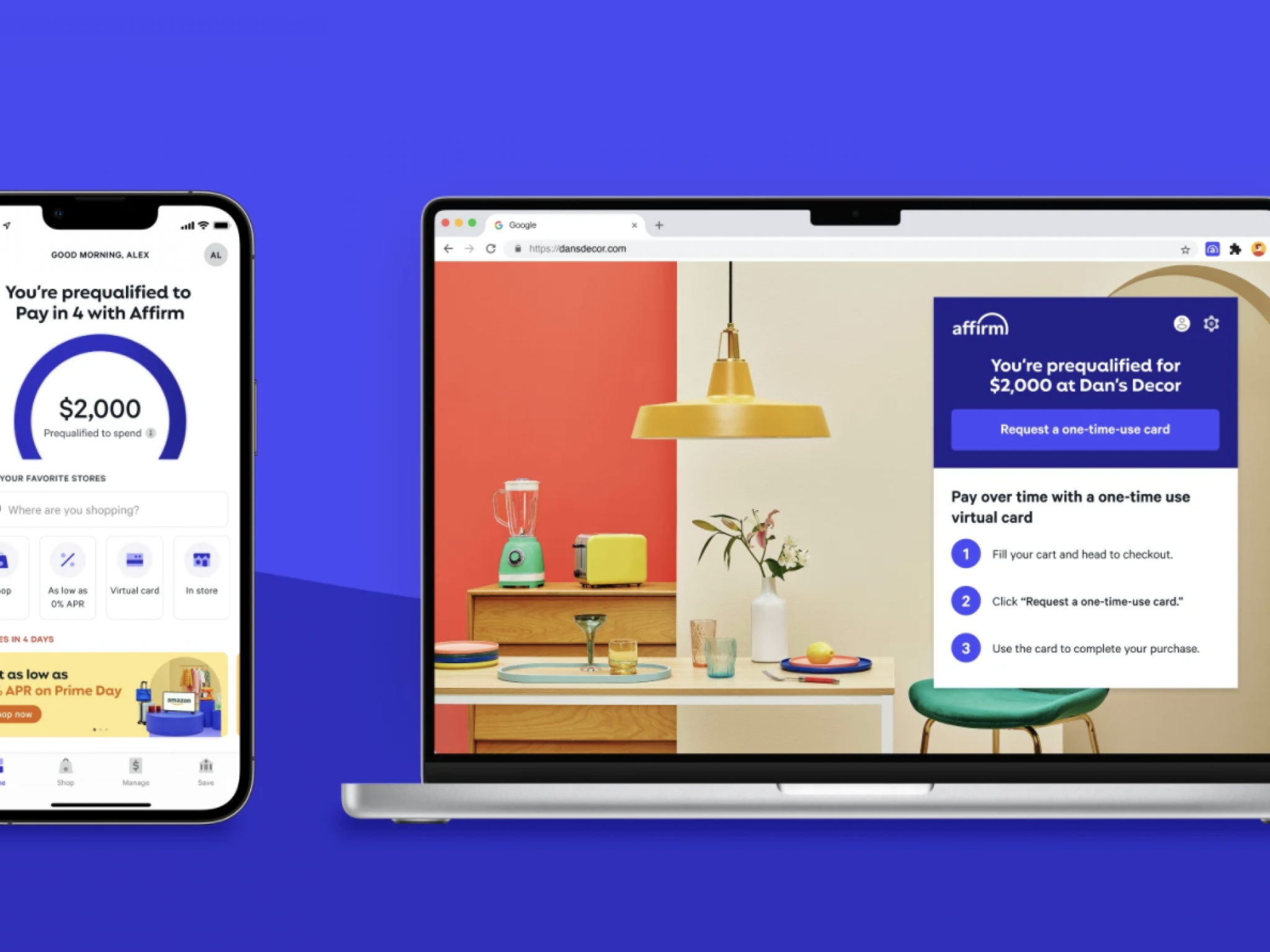

Affirm offers a platform for digital and mobile-first commerce. The platform consists of a point-of-sale payment solution for consumers, merchant commerce solutions and a consumer-focused app.

AFRM 52-Week Range: $30.78 - $176.65

Affirm shares were down 10.90% at $27.50 at time of publication.

Photo: courtesy of Affirm.