The word “mortgage” can trace its roots back to a medieval legal term meaning “death pledge.”

Things are not so dramatic today, but for most people, buying a house is the biggest expenditure of their lives. And lately it’s just getting more expensive.

DON'T MISS: 10 Cities Where Middle-Income Buyers Can Find Affordable Homes

In fact, a buyer on a $3,000 monthly housing budget has lost $30,000 in purchasing power over the last five months, in part due to mortgage rate increases, according to the real estate platform Redfin.

As of July 20, the 30-year fixed mortgage rate was 6.78%, up 1.24% from a year ago. The 15-year fixed mortgage rate was 6.06%, up 1.31% from a year ago.

One to two percent may seem like a small increase, but the effect on a monthly mortgage payment can be drastic -- especially when coupled with a surge in home prices.

“Prices are rising despite relatively low demand because there are so few homes for sale,” Redfin said in its housing market update. “New listings are down 27% year-over-year, the biggest drop since the start of the pandemic, and the total number of homes on the market is down 14%, the biggest drop since March 2022."

“That’s mostly because potential sellers are locked in by low rates; nearly all homeowners have a rate below 6%," Redfin reported.

The economy has an impact on mortgage rates, as they tend to rise when things are going well and fall when there’s a slowdown.

Mortgage Bankers Association (MBA) vice president and deputy chief economist Joel Kan expects mortgage rates to average 5.6% by the end of 2023, Forbes reported, while Realtor.com economist Jiayi Xu expects a gradual decline that could bring rates near 6% by year-end.

Compare the Best Loan Rates

Skyrocketing Mortgage Payments

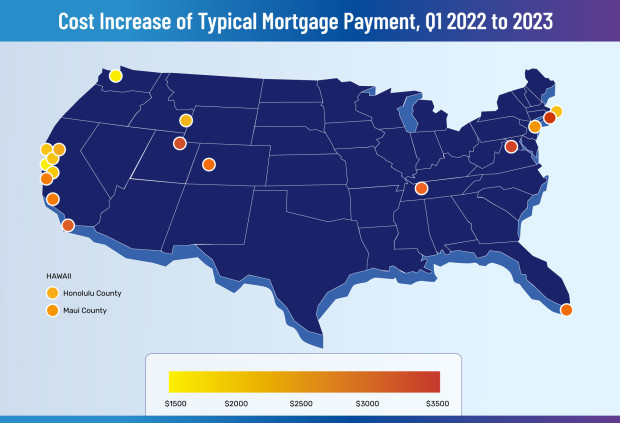

Broadly speaking, homeownership got more expensive over the last year for new buyers. In some housing markets the cost difference is stark, Q1 data from the National Association of Realtors reveals.

In 20 U.S. counties, the median mortgage payment rose at least $1,610 year-over-year, according to the data. In one pricey New York market, the typical monthly payment jumped more than $3,000.

To calculate these figures, NAR assumed a 10% down payment on a 30-year fixed loan, the most common type of mortgage (repeat homebuyers and first-time buyers, respectively, put down a median of 17% and 6%).

A homebuyers’ income, credit history, and other personal factors impact their individual mortgage rate and ultimately how much they pay each month.

The following table shows the counties where the monthly cost of a mortgage increased the most over the last year. Payments exclude additional monthly expenses like insurance and taxes.

| County, State | Median Home Price, Q1 2023 | Monthly Payment Q1 2023 | Cost Difference From a Year Ago |

|---|---|---|---|

Nantucket County, MA |

$1,444,050 |

$7,480 |

+ $3,440 |

San Mateo County, CA |

$1,575,280 |

$8,160 |

+ $2,890 |

Santa Clara County, CA |

$1,459,600 |

$7,560 |

+ $2,820 |

Dukes County, MA |

$1,143,610 |

$5,920 |

+ $2,720 |

Marin County, CA |

$1,467,100 |

$7,600 |

+ $2,700 |

San Francisco County, CA |

$1,458,510 |

$7,550 |

+ $2,680 |

Teton County, ID |

$1,102,970 |

$5,710 |

+ $2,180 |

Honolulu County, HI |

$965,000 |

$5,000 |

+ $2,080 |

Alameda County, CA |

$1,072,780 |

$5,550 |

+ $1,960 |

New York County, NY |

$1,042,100 |

$5,400 |

+ $1,890 |

Maui County, HI |

$898,020 |

$4,650 |

+ $1,870 |

Santa Cruz County, CA |

$1,020,890 |

$5,290 |

+ $1,850 |

Orange County, CA |

$956,470 |

$4,950 |

+ $1,840 |

Pitkin County, CO |

$875,480 |

$4,530 |

+ $1,800 |

Monroe County, FL |

$816,090 |

$4,230 |

+ $1,760 |

Williamson County, TN |

$774,160 |

$4,010 |

+ $1,710 |

San Diego County, CA |

$843,960 |

$4,370 |

+ $1,680 |

Summit County, UT |

$850,430 |

$4,400 |

+ $1,660 |

Falls Church city, VA |

$921,730 |

$4,770 |

+ $1,640 |

King County, WA |

$851,460 |

$4,410 |

+ $1,610 |

Nantucket, a small island off Cape Cod, Mass. and a top summer destination, saw the biggest jump in monthly payments among all U.S. counties.

California had three of the most expensive markets in the top five counties. San Mateo, one of the wealthiest counties in the U.S., saw the second-highest monthly payment increase. Many residents are associated with bioscience and computer software, which may explain why it is such an expensive place to live.

Housing Markets With Less Mortgage Rate Impact

Rising rates didn't have as much of an impact on buyers in relatively cheaper housing markets.

In Youngstown, Ohio, which has the highest share of affordable homes on the market for middle-income buyers, monthly home payments increased a mere $300 from a year ago. In Akron, Ohio, another affordable metro area, monthly payments increased just $380 from a year ago.

The Takeaway: California housing markets have recorded some of the biggest increases in mortgage payments over the last year, pushing the median monthly payment as high as $8,000 in one county.