The already-reeling U.S. pay TV business could see as much as 10% of its remaining base defect to Disney, Fox and Warner Bros. Discovery’s new sports bundle joint venture, an extinction-level event that would “make it hard for operators to stay afloat,” said Aluma Connected TV Insights analyst Michael Greeson.

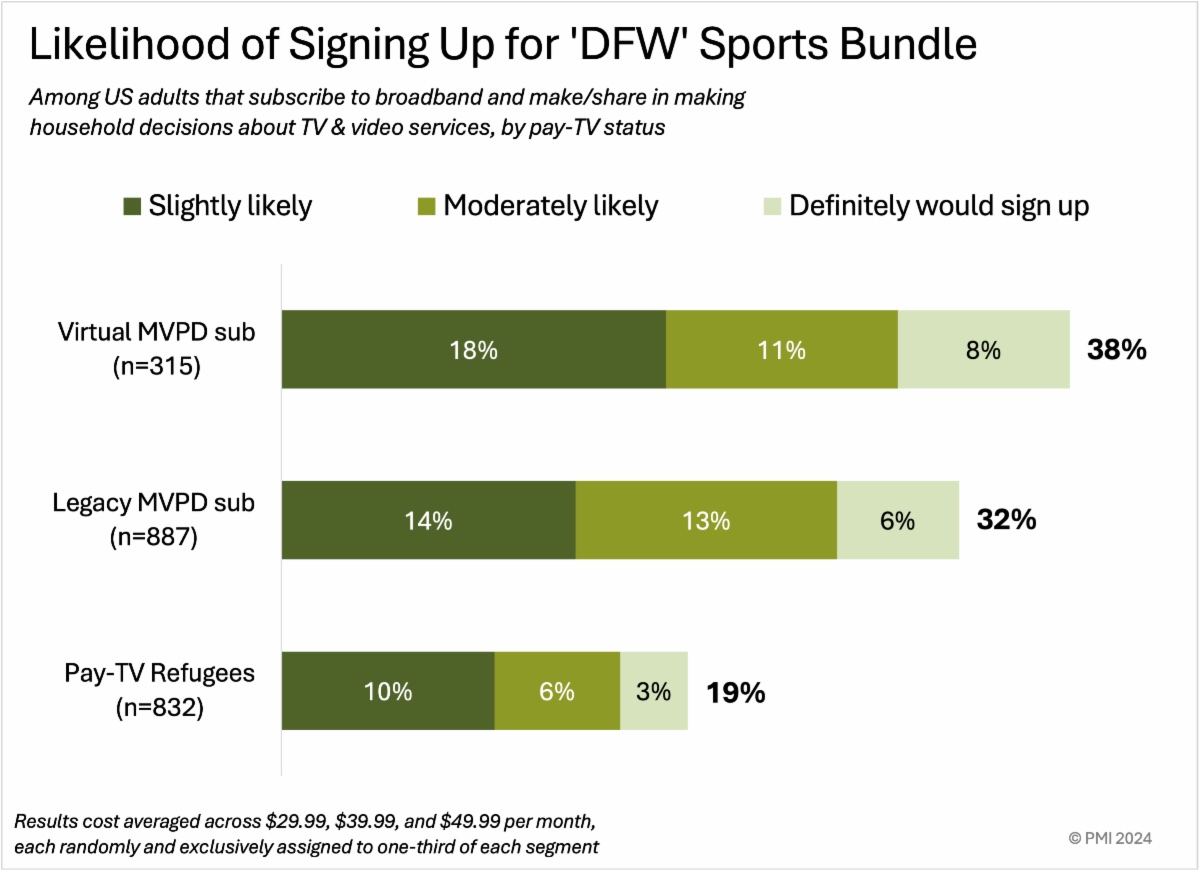

According to Aluma, about 32% of traditional MVPD users and 38% of virtual pay TV subscribers indicated some level of "likelihood" that they'd sign up for the new, as-yet unnamed JV, nicknamed Spulu by flippant, glib media trades like our own.

And among that subset that indicted a likelihood to sign up for Spulu, up to 52% of that cohort, depending on Spulu’s ultimate price point, indicated a corresponding probable indication that they'd cancel their current pay TV service.

That works out to about 10% of the overall remaining U.S. pay TV customer base cutting the cord, Greeson surmises.

“A loss of even 10% of the already-declining base of MVPD subscribers would severely diminish the ability of operators to stay afloat,” he noted. “And if those launching the DFW bundle intend to rely on pull from those without pay TV, they can forget about it. Only 9% are legitimate prospects for the service.”

The analyst also sees Disney’s upcoming direct-to-consumer launch of ESPN as also being potentially fatal to some operators. Among the 2,023 U.S. consumers polled by Aluma in February and March who were identified to be “poised” to sign up for DTC ESPN, 46% “are at least moderately likely to consequently cancel pay TV, and 12% who would definitely cancel,” Aluma’s Consumer Receptivity to New Sports Bundling Services report states.

Also Read: Virtual MVPDs Are Only a ‘Secondary’ Programming Source, Study Says

Particularly exposed, Greeson said, is Fubo, which is currently suing the Disney/Fox/WBD JV in federal court over antitrust matters. The analyst said Spulu could siphon off 10-15% of Fubo’s customers by next year.

Of course, all of this is being predicted without even knowing Spulu’s ultimate price point.

“One factor that could constrain uptake of the new bundle is price,” Greeson added. “At the moment, there is a modest consensus it will launch at $50 a month. If it does, it would lessen its disruptive potential.

Greeson said cord-nevers and cord-cutters have little interest in the JV. And the interested group of mostly pay TV denizens is price-sensitive — the more expensive the JV bundle is, the more likely they are to ditch their current service.