Financial rights expert Julia Davis says Newcastle residents who live in a flood zone should take out flood insurance, even though shopping around for the best deal is "difficult" and "frustrating".

Ms Davis will address a free community information session at St John's Anglican Church hall in Cooks Hill on Thursday night organised by residents groups and former Lake Macquarie City Council climate adaptation officer Greg Giles.

"If you live in a flood zone, you should seriously consider getting flood cover," Ms Davis said.

"A lot of people opt out of flood cover because it is the most expensive part of your policy, but I've seen so many heartbreaking stories."

Ms Davis sympathised with Newcastle residents whose insurance premiums had gone through the roof in recent years and suggested some insurers simply did not want to write policies in certain suburbs.

"They are trying to get rid of customers in certain postcodes," Ms Davis said.

"They are rebalancing their portfolios across the country. They may have copped more claims recently.

"There are a lot of reasons that have nothing to do with your actual house.

"I wouldn't trust an insurer to give you a fair price, but I also wouldn't assume that they're trying to screw you over."

Residents in some flood-prone suburbs of Newcastle have faced premium quotes up to $30,000.

One Wickham resident said her annual premium had jumped from $2500 to $17,000 in November 2022.

The woman, who plans to attend Thursday night's meeting, removed the flood component of her insurance and the premium dropped back to $2500.

A year later, in November 2023, her premium increased to $3500, without flood cover.

"I am concerned with the direction of insurance in this area," she said.

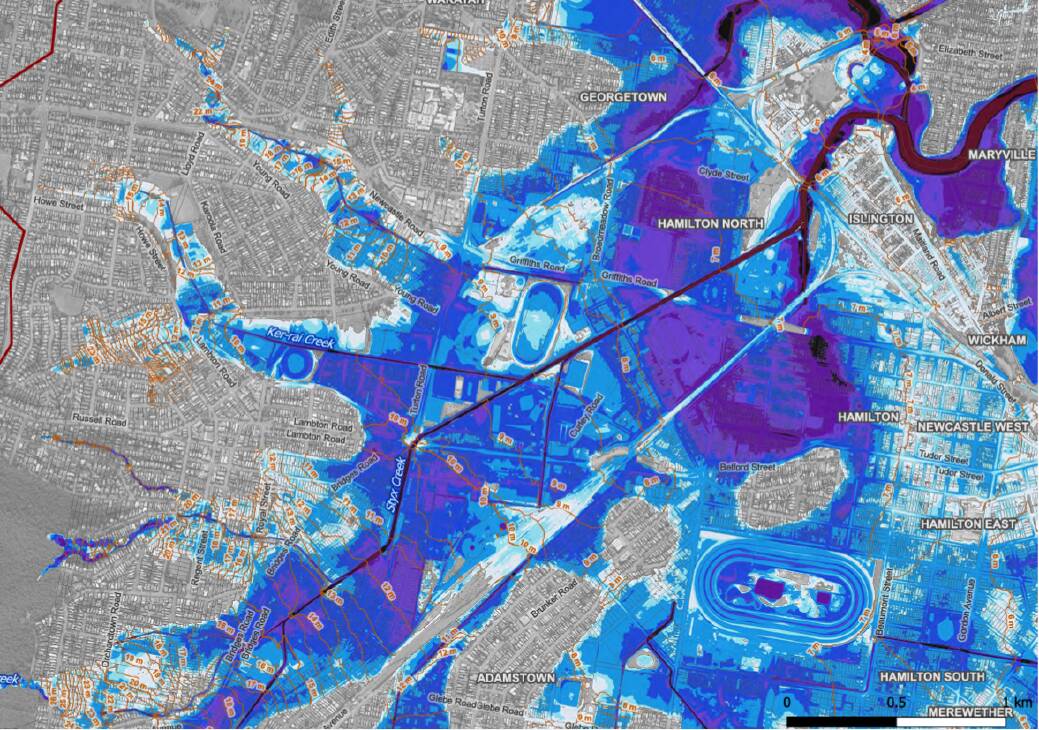

City of Newcastle approved a new flood study late last year which classified an extra 2000 homes as "flood-affected" after taking into account the impact of climate change.

The Throsby, Styx and Cottage Creeks Flood Study area covered Adamstown, Broadmeadow, Carrington, Cooks Hill, Georgetown, Hamilton, Hamilton North, Hamilton South, Islington, Kotara, Lambton, Maryville, Mayfield, Mayfield West, Merewether, New Lambton, Newcastle West, The Junction, Tighes Hill, Waratah, Wickham.

The council plans to complete a similar study for the western half of the city.

Ms Davis is a senior policy and communications officer at the Sydney-based Financial Rights Legal Centre, a free service funded by the state and federal governments.

She will emphasise at the Cooks Hill meeting the value of comparing insurance premiums every year.

"Insurers make you pay a loyalty tax," she said.

"If you just hit renew every year, I promise you you are paying more for insurance than you need to be.

"They offer new customers much bigger discounts than returning customers. There's plenty of evidence for that.

"If you shop around, you will absolutely find something cheaper. That doesn't mean it will be affordable."

The Actuaries Institute published a report last year which showed median home insurance premiums had risen 28 per cent across Australia and 50 per cent for the highest-risk properties.

Ms Davis said spiralling building costs, higher global re-insurance premiums and "straight-up price-gouging" had contributed to the rises.

"Insurance prices are going up all over the place, and flood is probably the biggest driver of the biggest increases," she said.

"A lot of experts would say insurance in Australia has historically been under-priced and now the global market is kind of catching up to what the risk really looks like and pricing it accordingly.

"The cost of building materials and labour has gone way up. Some of that's inflation.

"Some of that's housing in Australia is really expensive and the cost of fixing it is really expensive."

She said the price Australian insurance companies had to pay to reinsure themselves had "gone way up".

"Globally the players like Lloyd's are looking at Australia and realising it's not really the safe bet it used to be.

"Some of that is climate change, but some of it is our own fault because we've been building in really dumb places for a long time."

Ms Davis said her own experience of trying to renew her house insurance made it clear how difficult the process can be.

"I think most consumers would start to shop around and find the process really frustrating and probably don't do a very thorough job of it.

"It takes a long time, you're not confident you're doing it right, there's almost no way to compare products in a meaningful way, and how do you even know if you're shopping around for the right amount of cover?

"Most people, myself included, have no idea what it costs to build a house.

"And, even if you do, there's about five companies that own 100 brands. I could look at GIO and APIA and not even realise that those are all just owned by the same company.

"I'm not even shopping around. They're all the same underwriter. Who knows that?"

She said she had used insurance industry calculators to try to work out the cost of rebuilding her house.

"Some of them said I could rebuild my house for $550,000 and others said it would cost me $1.2 million," she said.

The information session begins at 6pm on Thursday night.