PEOPLE will die this winter if there is not more support to help with the cost of living crisis, a charity has warned.

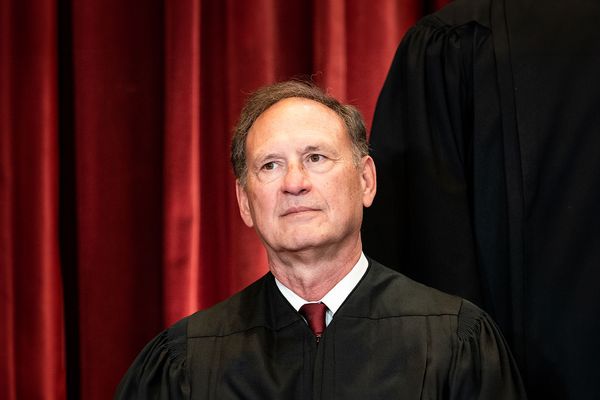

Age Scotland chief executive Brian Sloan, pictured, said that while the proposed £2500 energy price guarantee would provide “some mild relief”, nothing announced so far by the UK Government is enough to protect older people against the “devastating impact” of rising costs this winter.

“Especially when you consider that, on average, people will be paying about twice as much to heat and power their homes as they did last year,” said Sloan.

He added that for those who rely on off-grid oil to heat their homes, who have already been paying “sky-high” prices, only receiving £100 towards those costs seemed “insufficient”.

“We need the UK Government to do even more to support those on the lowest and modest incomes to better cope with this crisis before the colder weather begins to really bite,” Sloan said.

“The next Ofgem price cap increase, coupled with news that interest rates have now reached the highest level we’ve seen for 14 years, poses serious risks not only to financial security but also to health, as an increasing number of people find themselves faced with impossible choices between heating and affording other essentials.

“We’ve been urging for months that more needs to be done to support older people sooner rather than later, and the grim reality is that people will die if we do not see this support.”

Reacting to the Chancellor’s mini-Budget last week, the StepChange debt charity said it would leave financially vulnerable households continuing to face risks that would also damage the wider economy.

“The position of those households with the least financial resilience and the greatest vulnerability to problem debt remains precarious, despite the measures announced,” said StepChange director of external affairs Richard Lane.

“Those having to rely on means-tested benefits – which have still not been uprated, even though the cost of food and other essentials has risen – are already over-represented among households experiencing problem debt.”

He pointed out that the debt and financial insecurity households are struggling with creates significant social costs.

“It will be essential that the Government remains open to finding other ways to support and nurture the financial position of those on low incomes, recognising the benefit this provides not only to hard-pressed households but also to the wider economy,” said Lane.