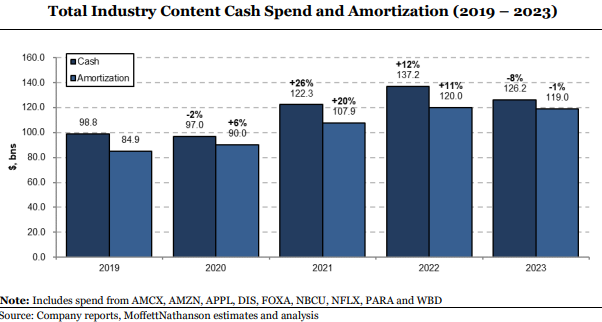

After falling from its peak in 2022, spending on television content will rise in 2024, but it won’t reach the levels hit two years ago, according to analyst Robert Fishman of MoffettNathanson.

Spending patterns are changing, Fishman noted, with most of the growth coming from streamers rather than traditional media companies. Sports programming will also get a big share of the spending increase, leaving less cash for entertainment content.

“2023 saw the end of several years of significant content spending increases across the industry, fueled by pivots to DTC, new entrants to the media space and fierce competition for subscribers,” Fishman said in a report Friday. “The limited (or more likely, negative) ROI of this incremental spend, as well as maturation and cooling of the Streaming Wars, likely would have put an end to the double-digit growth had the Hollywood strikes of last year not gotten there first.”

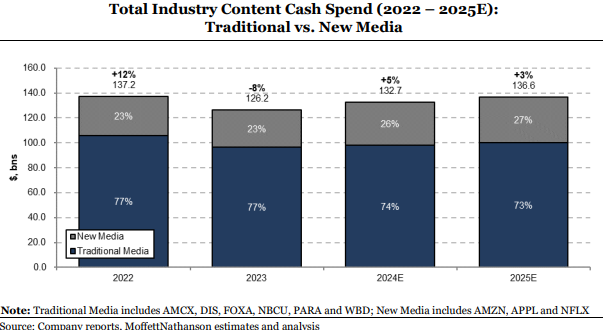

In 2022, the industry spent $137.2 billion on content on a cash basis, Fishman said. Spending fell to $126.2 billion in 2023.

Fishman forecasts that cash spending on content will increase 5% in 2024, following an 8% drop in 2023, leaving spending 3% below 2022.

In coming years, Fishman see content spending increasing at only single-digit rates.

Much of that future growth will come from newer players in the video business.

While Fishman sees spending by traditional media companies down 7% from 2022 levels, Apple, Amazon and Netflix taken together will be up 10%.

Traditional media will account for less than 75% of content spending in 2024 and will continue ticking down from there, he said.

At the same time, content spend is shifting to sports-related spending. Fishman said.

He forecast that sports spending will rise 11% from 2022, while non-sports spending declines 7%.

“We expect a major step down in non-sports spend relative to 2022 across most traditional media companies, with the exception of small, Tubi-driven step up at Fox and a slight step down at NBCU,” Fishman said. “At Disney, we forecast a decrease in its non-sports cash spend by a full -30% in 2024 vs. 2022, or more than $6 billion!”

Fishman also expects non-sports content spending to fall 9% at Warner Bros. Discovery and14% at Paramount Global.

Meanwhile, spending at Netflix is expected to be 1% higher, while Apple boosts non-sports spending by 17% and Amazon by 18%.

And all of those streaming companies also seem to be increasingly prioritizing sports, he notes.