Netflix Inc. (NFLX) is a FAANG stock that’s enjoyed a substantial rally this year. Like most stocks, Netflix shares were dragged lower in the first half of 2022 by worry a worsening economy would slow new member growth. Those concerns remain, but investors have gotten increasingly bullish on Netflix stock on optimism that a crackdown on membership sharing may more than offset economic headwinds.

Can Netflix’s stock continue climbing, or has it seen its highs for this year?

Image source: Jakub Porzycki/NurPhoto via Getty Images

Netflix’s Financials Remain Solid

Netflix began as a mail-order movie service designed to compete against Blockbuster. Today, the brick-and-mortar movie rental business has disappeared. At the same time, Netflix has become a global content powerhouse, with more subscribers than competitors, including Disney (DIS) Plus and Paramount (PARA) Plus.

Netflix's media catalog boasts over 13,000 titles, it produces its own movies and top-selling TV series, such as Stranger Things, and its 232 million subscribers span the globe.

DON'T MISS: Netflix Is Finally Trying What Amazon, Apple Are Doing With This Major Move

In the U.S., the company has mostly penetrated the market, so it’s fastest-growth is likely behind it. Nevertheless, revenue remains stable, and the company is nicely profitable with a solid balance sheet.

Last quarter, sales grew 4% year-over-year to $8.2 billion. Earnings per share slipped 18% from last year but still came in at a healthy $2.88 per share. Wall Street analysts estimate EPS will grow 14% to $11.38 in 2023 and 29% to $14.69 in 2024.

Netflix spends heavily to produce movies and TV shows worldwide, but that hasn’t kept it from building a healthy cash stockpile. It had $7.8 billion in cash and equivalents exiting March, up from $6 billion one year ago. Its total debt is $17 billion, but the current portion of that debt payable within the coming year is manageable. Netflix's current ratio, a measure of short-term cash relative to short-term liabilities, is a healthy 1.26.

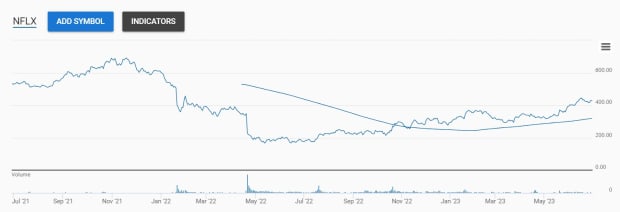

Netflix’s Stock Chart Results In A New Price Target

Technical analysis provides insight into the aggregate sentiment of every investor, including prominent money managers who have resources available to them that individual investors can only imagine.

Charting price action allows investors to spot trouble often early on. Similarly, charts can be used to calculate potential price targets, particularly if you use point-and-figure charts.

Real Money technical analyst Bruce Kamich has reviewed charts for professional investors for over 40 years. Recently, he evaluated Netflix’s charts for clues to what may happen next for the video streaming company’s shares.

He considered the stock’s price action, volume trends, and momentum to come up with his recommendation. Then, he used the daily and weekly point-and-figure charts to calculate price targets.

Kamich came away impressed by Netflix’s charts.

“I see a positive setup. Prices are in an uptrend and trade above the rising 40-week moving average line…The weekly OBV line is bullish, and so is the MACD oscillator,” wrote Kamich.

On-balance volume is essentially a running total of up to down day volume while moving average convergence divergence (MACD) is a momentum indicator.

Based on the daily point-and-figure chart, Netflix stock has already reached Kamich’s $415 price target. However, his eye-popping weekly point-and-figure chart price target of $715 suggests the path of least resistance is higher long term.

That’s encouraging, given investors may be nervous about the potential fallout of a looming writer’s strike industry-wide, and whether Netflix’s crackdown on password sharing will alienate consumers.

What’s Next for Netflix’s Stock?

Point and figure charts can provide price targets but don’t offer a timeline to attain them. As a result, Netflix shares could pull back short-term, given the stock has gained significantly this year.

Nevertheless, technical analysis suggests that selloffs in Netflix’s stock could be a buying opportunity. Rather than expecting the stock to rally to over $700, Kamich recommends targeting $500 first and then reevaluating from there. He also suggests that investors run a stop loss below $405 to protect against losses if the stock falters.

His $500 target is in keeping with Wall Street analysts. Recently, Bank of America increased its price target to $490 from $410 based on data from Antenna showing some of the largest user acquisition days for the company in over four years. Bank of America's analysts increased their new users forecast to 18.7 million this year from 13.7 million.

Citibank similarly lifted its target to $500 from $400 on the potential for Netflix's management to say positive things about video streaming membership when it reports quarterly earnings on July 19. Wall Street analysts' consensus forecast is for quarterly revenue of $8.26 billion and earnings per share of $2.83.

If Netflix outperforms those forecasts, analysts' upward revisions to the full-year earnings estimate could be a catalyst that helps shares move up toward Kamich's target.

July 4th Sale! Receive full access to real-time market analysis along with stock, commodities, and options trading recommendations. Sign up for Real Money Pro now for 65% off.