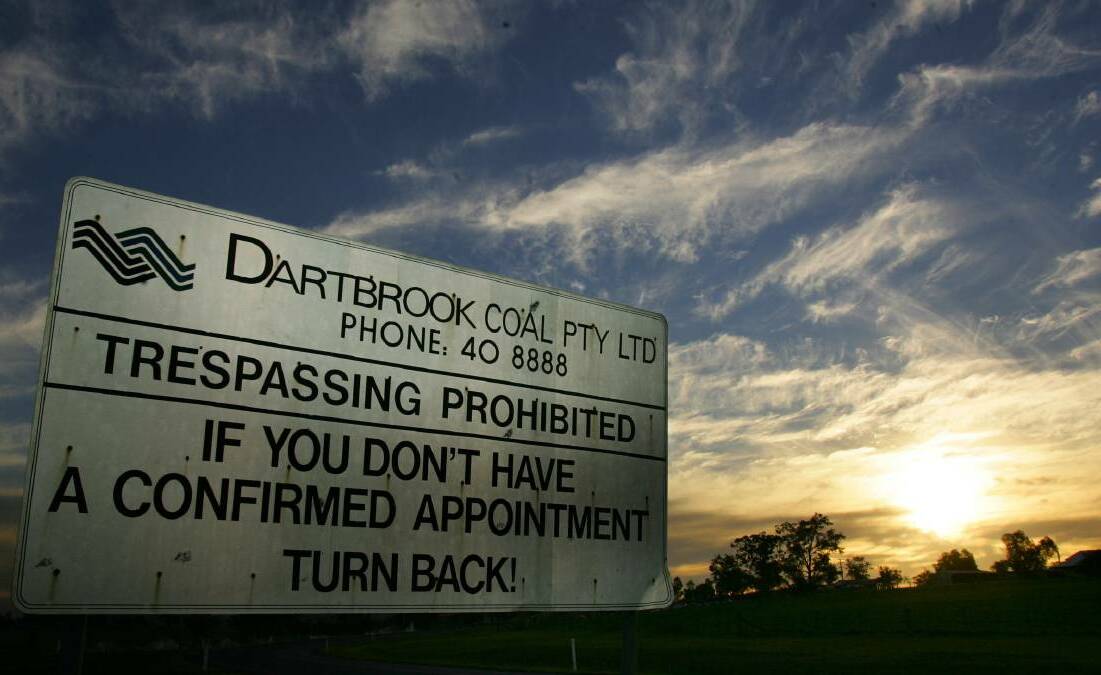

THE former billionaire and discharged bankrupt Nathan Tinkler is attempting to regain control of the Dartbrook underground coal project at Aberdeen, owned by the stock exchange listed Australian Pacific Coal.

On Monday, AQC (the company's stock exchange "ticker") announced it had received a non-binding takeover bid from Mr Tinkler, who proposed buying 20 per cent of the company for $3.78 million, refinancing its debt and interest (put at $65 million in company documents) and launching a takeover bid for the entire company at up to 30 cents a share.

AQC had been on the verge of selling Dartbook to another of its shareholders, a company called Trepang Services Pty Ltd, associated with Nick Paspaley of the Northern Territory pearling family, and Darwin real estate John "Foxy" Robinson.

Documents show Trepang offering to take over AQC's $30 million debts and $35 million in interest, with the company to receive a royalty of $2.50 to $5 a tonne - depending on price - on half of any coal sold from Dartbrook, should it finally reopen.

AQC told the stock exchange an extraordinary general meeting to vote on the Trepang deal had been postponed to consider the Tinkler proposal, which included appointing him as executive chairman.

The bid vehicle, a company called Nakevo Pty Ltd, had backers including an unnamed but "credible fund manager with in excess of $4 billion in capital under management".

Mr Tinkler was first involved with AQC in December 2015 when he and the two NT figures bought the shuttered Dartbrook mine from previous owner Anglo American in December 2015 for $25 million plus royalties that could double the eventual price.

Anglo had closed Dartbrook in 2006 during a coal price slump and after three mining fatalities in a decade.

Struggling globally, Anglo put other Australian mines on the market and had its proposed Drayton South open-cut rejected by the NSW government after strong opposition.

Having fallen from the heights of his Middlemount and Aston Resources coal fortune, Mr Tinkler resigned his initial AQC director's role in 2016 when he began a two-year bankruptcy.

If he retained any shareholdings, they were not obviously apparent in AQC's published lists of "top 20 shareholders".

Neither he nor AQC responded to repeated requests yesterday for comment.

The Tinkler/AQC attempts to reopen Dartbrook have hit various hurdles but with coal trading at US400 ($580) a tonne - or eight times what it was in mid 2020, the long-shut mine's commercial fundamentals are looking more attractive than at any time since Anglo American transacted to sell the mine in late 2015.

One such setback came in 2019, when a planned sale of half of Dartbrook to Canadian based Stella Resources fell through. The parties had announced the deal the year before, with Stella set to inject $20 million into the project.

The proposal that AQC should sell Dartbrook to its Northern Territory based shareholders was announced in February.

On August 11, AQC provided a shareholder update, saying that if the offer was accepted an extraordinary meeting on Monday, "AQC's consolidated liabilities will be reduced by approximately $65 million (and) AQC will receive a royalty from the net profits . . .of between $2.50 and $5 a tonne of "grantor coal"". Grantor coal was defined in other documents as "50 per cent of the coal sold from the Dartbrook mine".

In Monday's statement on the Tinkler bid, AQC said the shareholders of the bid vehicle, Naveko Pty Ltd, were "Oceltip Coal 2 Pty Ltd (an entity controlled by Nathan Tinkler), Evolution Capital Pty, [and] a credible fund manager with in excess of $4 billion in capital under management, and a number of other financial investors".

No date has been set for another extraordinary general meeting, which would be "announced in due course (if relevant) . . "

WHAT DO YOU THINK? We've made it a whole lot easier for you to have your say. Our new comment platform requires only one log-in to access articles and to join the discussion on the Newcastle Herald website. Find out how to register so you can enjoy civil, friendly and engaging discussions. Sign up for a subscription here.