Jeremy Hunt handed a huge pensions giveaway to the wealthiest 1% to help stem the tide of people leaving the workforce, in a budget designed to reboot Britain’s faltering economy with business investment incentives and childcare support.

In an attempt to keep older skilled workers from retiring early, Hunt announced his only big surprise of the budget – to scrap the £1m cap on tax-free pension savings, saying: “No one should be pushed out of the workforce for tax reasons.”

The chancellor claimed his “budget for growth” would address Britain’s two big structural economic weaknesses – a lack of investment and a shortage of workers – but the most eye-catching measure was the pension boost for the top 1% of earners.

Someone with a £2m pension pot will get a tax cut of £275,000 when they take their tax-free lump sum as a result of the change.

The Labour leader, Keir Starmer, attacked the move, questioning how it could “possibly be a priority for this government”, while other critics noted Hunt’s statement said nothing about public sector pay.

Torsten Bell, chief executive of the Resolution Foundation thinktank, said the chancellor had “basically ignored” public services, leaving them facing “implausibly tight spending plans”. Bell added that it means “rich people now have no overall limit on how much can be put into their pension pots tax-free”, and can pass this on to their heirs with “absolutely zero inheritance tax”.

“The more you think about this policy the worse it is,” he said.

Hunt, however, insisted the British economy was “proving the doubters wrong” and would narrowly avoid a technical recession in 2023, as he set out £22bn of higher spending and tax breaks in the next financial year.

His giveaway reversed only part of the £55bn of spending cuts and tax increases previously announced.

Paul Johnson, the director of the Institute for Fiscal Studies thinktank, said the freezing of tax allowances next month would cost the average taxpayer £500 a year and higher rate taxpayers £1,000 a year.

“The declinists are wrong, and the optimists are right,” Hunt said, hailing a stronger-than-expected economic performance since last year’s turmoil. “We stick to the plan because the plan is working.”

However, the economy is still expected to shrink by 0.2% this year and the Office for Budget Responsibility warned that the better growth in the short term would come at the expense of weaker growth in future years.

Hunt delivered his budget against a backdrop of the worst day’s trading on the London stock market since Vladimir Putin launched his full-scale invasion of Ukraine in February 2022.

Fresh fears over the health of the global banking sector triggered a wave of selling in the City, across Europe and on Wall Street. Switzerland’s Credit Suisse plunged to record lows, down 30% at one stage, after its largest shareholder said it would be unable to invest more money in the bank.

Despite the extension of government support for energy bills until July, Britain remains in the grip of a cost of living crisis which the OBR confirmed meant real living standards will fall by a cumulative 5.7% over the next two years – still the largest fall in living standards since records began.

Hunt said inflation – expected to fall from 10.1% to just under 3% by the end of the year – was the root cause of the current wave of strikes, but he offered no new money to help settle the pay disputes.

“That’s a political choice”, said Johnson, who noted the £6bn used to freeze fuel duty could have spent on inflation-matching pay awards for public sector workers. “Money for motorists, but not for nurses, doctors and teachers.”

Labour criticised the short-term nature of some of the measures, with Starmer insisting the budget “leaves us stuck in the waiting room, with only a sticking plaster to hand, a country set on a path of managed decline, falling behind our competitors”.

Hunt’s core theme of his spring budget was a push to fill more than a million vacancies in the British workforce, with a three-pronged effort to incentivise early retirees, parents of young children and those with long-term health issues back to work.

Families will get the biggest boost to free childcare provision in history, as revealed by the Guardian on Wednesday, though parents of one and two-year-olds will not receive 30 free hours of care until September 2025.

Those on disability benefits will get space to re-enter the workplace without the threat of a re-assessment of their disability should they leave – though the Treasury is also set to launch a sanctions crackdown on short-term jobseekers.

Hunt said his measures were designed to encourage people back to work after a dramatic fall in employment among over-50s since the Covid pandemic, which had left businesses already affected by Brexit grappling with chronic staff shortages.

He will increase the pensions annual tax-free allowance by 50% from £40,000 to £60,000 and abolish the lifetime allowance from its £1m limit, a move primarily aimed at persuading NHS consultants and GPs to carry on working.

Officials claimed the move – which will cost £800m a year – was the “quickest and most effective” way of addressing the shortage of senior doctors and therefore driving down hospital waiting lists, one of Rishi Sunak’s key priorities.

However, the government faced questions over why it had not set up a bespoke scheme for NHS consultants, as it did for judges in April 2022. Labour’s analysis suggested the measure will cost the taxpayer £70,000 for every person returned to the labour market.

Hunt’s childcare reforms were warmly greeted by Conservative MPs in the Commons, including key campaigners like Siobhan Baillie who had lobbied for the chancellor to do more for working parents.

The changes, which the OBR predicted would raise employment by 60,000, will be staggered, with the full 30 hours offer not available until September 2025.

The pace of the change was a tacit acknowledgment of pressures on recruitment and funding in the sector, though Hunt said he would boost funding for places next year, still well below the sector’s projected £2bn costs.

Almost half of Hunt’s giveaway was spent on a three-year tax break to stimulate business investment following the increase in corporation tax from 19-25% that will come into force next month. Firms will be able to write off 100% of their capital spending against tax, costing the Treasury more than £10bn in 2024-5.

On Wednesday evening Hunt refused to commit to tax cuts ahead of the next general election. He told ITV’s Peston show: “My job is to do the right thing for the economy, and then people will see that they can trust the Conservatives to get the economy growing. That’s the electoral dividend – I’m not interested in playing games.”

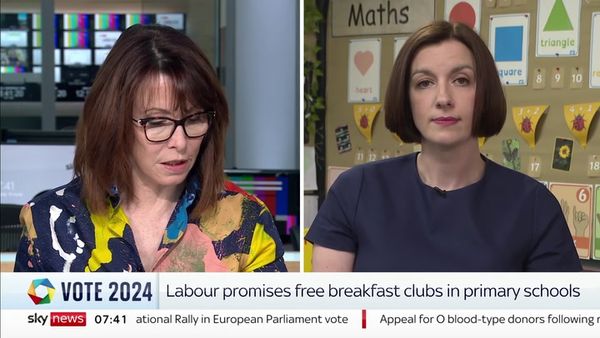

Labour has pledged to reverse the pensions tax break for high earners if it gains power at the next election and create a targeted scheme for doctors rather than allowing a “free-for-all for the wealthy few”.

The shadow chancellor, Rachel Reeves, told Peston that her party will seek to force a vote on the pensions issue next week. “I think this could unravel as quickly as it began,” she said. “If you remember last September, Liz Truss tried to cut the top rate of tax from 45p to 40p, everybody kicked off about it.

“Next week there will be a vote on this. And I would say to Conservative MPs in places like Ashfield, or Bolsover, or Stoke-on-Trent, whose side are you on? Are you on the side of ordinary working people in your constituencies who are seeing their taxes go up, or are you going to vote with Rishi Sunak and Jeremy Hunt for a tax cut for the wealthiest in society?”

The government is likely to come under pressure in the coming days over forecasts that net migration will rise to 245,000 a year, according to the OBR. There had been “significantly higher levels” of migration from outside the EU since Brexit than the fiscal watchdog had previously assumed.