Managing money in a family with multiple children is no mean feat. Parents have to balance saving for the future with giving their children the best possible life right now. A caller to money management expert Dave Ramsey’s show caused some surprise when he revealed that he spends $80,000 a year just for daycare.

Commenters debated Dave’s advice and whether or not this was a reasonable amount to spend. We reached out to Dave Ramsey via email and will update the article when his team gets back to us.

More info: TikTok

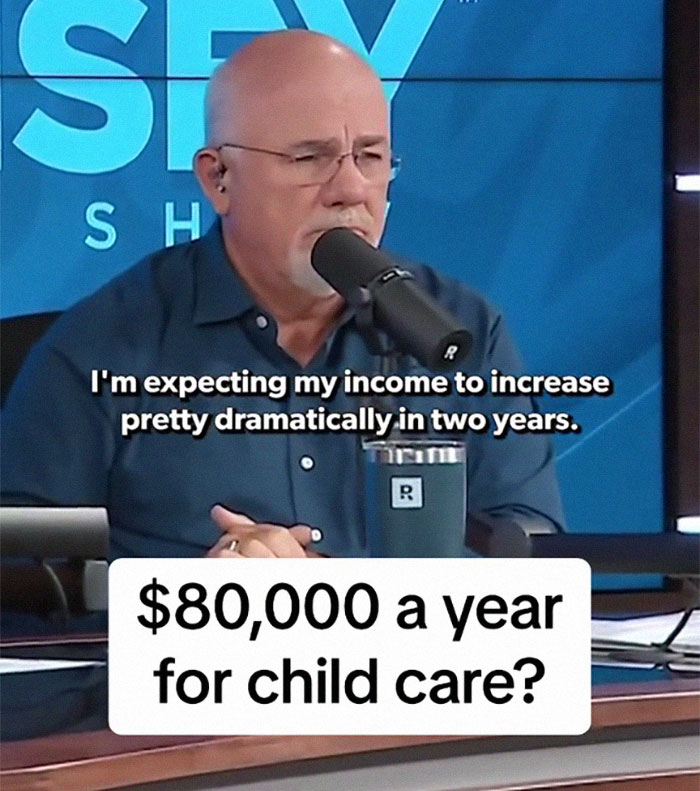

A man called financial guru Dave Ramsey for advice when he found himself struggling to pay $80,000 for his kid’s daycare

“The caller: I’m expecting my income to increase pretty dramatically in two years, but in the meantime, I’m having trouble paying costs, including two kids in daycare. My wife is doing a medical residency, so in two years, she’ll be done with that and get a job as a doctor.

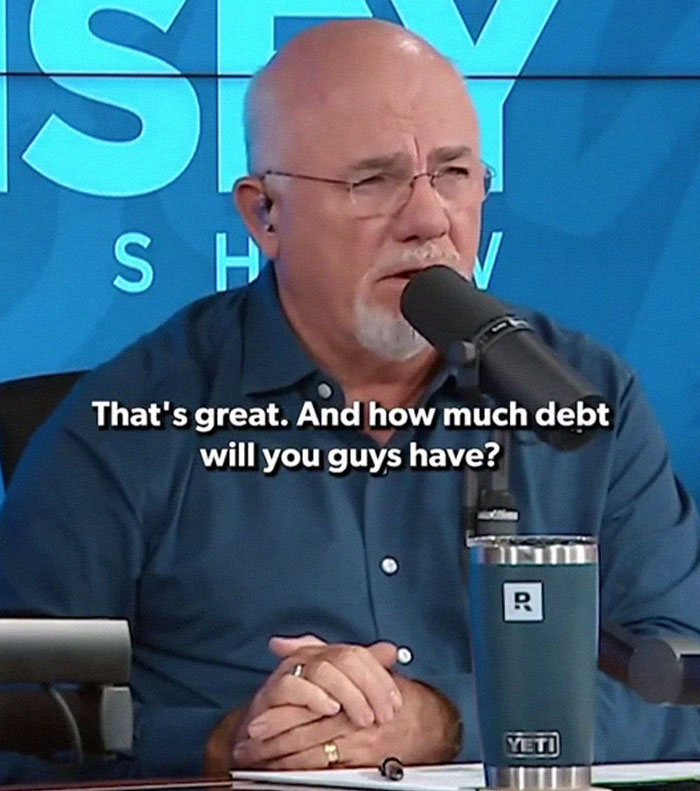

Dave Ramsey: Yeah, that will increase things pretty dramatically. And how much debt will you guys have?”

“The caller: We own a house, and aside from the house, we have about $25,000 in student loan debt.

Dave Ramsey: And is she borrowing to finish medical school?

The caller: No, she has no med school debt. So the student debt is mine.”

“Dave Ramsey: So what’s she making in residency?

The caller: About $70,000.

Dave Ramsey: And what are you making?”

“The caller: About $110,000.

Dave Ramsey: Can you explain to me why you can’t get by on $180,000? And you have to borrow money because you can’t get by on $180,000?

Jade: No, something’s not right.”

“The caller: The childcare costs are about $80,000.

Dave Ramsey: $180,000 and you’re going to explain that with child care costs?

Jade: Hold on, how much are you paying a month in child care?”

“The caller: It’s about $80,000 a year.

Dave Ramsey: Why? You brought them in college?”

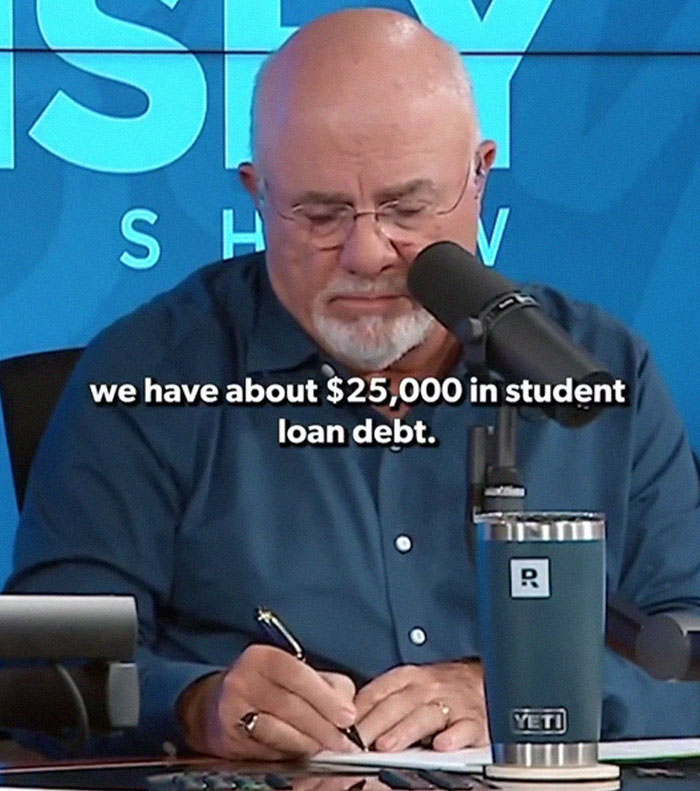

“The caller: The base tuition for the child daycare we use is $25,000 per kid, then we pay extra for early care and aftercare, and it doesn’t go during the summer, so during the summer we need a nanny.

Dave Ramsey: I’m going to be as nice as I can. You guys have lost your minds.”

“Jade: There’s cheaper routes.

Dave Ramsey: Oh, you think? You got them in some kind of dadgum… I mean, are they going to Harvard? What the hell?”

“The caller: it is a pretty fancy daycare.

Jade: you can downgrade.

Dave Ramsey: They’re not even in school and you’re already paying 25, 000 a head? Yeah. Come on, dude. That’s just dumber than c**p.”

“Jade: Seriously. Downgrade. It’s time to take the kids off filet mignon.

Dave Ramsey: I don’t care how much money you make. There’s not enough money in the world that doesn’t make that stupid.”

“Jade: Find you a free summer camp. Anything. During the summertime.

Dave Ramsey: So we’re going to borrow money now. We’re going to take out student loans for the four-year-old because that’s what we’re coming down to. You make $180,000. Yeah, I think you need to become frugal. If that’s what the definition of living on $180,000 is.”

“Jade: Look, daycare can be expensive, but it doesn’t have to be that expensive.

Dave Ramsey: $25,000 a kid? Yeah, I think not. Unbelievable.”

You can watch the full videos here

@daveramsey This couple is spending $80,000 a year for child care. #childcare #daycare #moneytok ♬ original sound – Dave Ramsey

@johnbmortgage #Duet with @Dave Ramsey Obviously Dave is clueless about real life childcare costs for American parents. The truth is a majority of households pay 20% or more of their total income on preschool, daycare, aftercare, nannies etc. And that doesn’t mean those are the stupid people and the other third found a “cheaper route”. The remainder either have one parent or other family member at home or they have a high enough income to keep the cost under 20%. So here in the real world childcare costs are a serious burden on our financial stability, and Dave needs to wake up and realize that envelopes and being thrifty won’t cut it here. Get your act together @Dave Ramsey . It’s 2024 let’s lose the 1984 mindset. #cluelessguru #daycare #childcarecosts #householdfinances #expenses #daveramsey #inflation #income #johnbandme ♬ original sound – John Birke 🏡 Mortgage Hacker

@sheisapaigeturner There is a childcare crisis in our country. The cost of childcare is astronomical. The cost of childcare is typically the biggest financial burden for a family with young children. The cost of childcare is rising at a faster rate than any other expense for families. People like Dave, pretending that this isn’t happening is wild to me because it is documented that this is indeed the cost of daycare. Dave should not be giving advice unless he’s well-versed in the topic. ##daveramsey##childcarecrisis##childcare ##daycare##daycarelife##millennialmom##workingmom ♬ original sound – Paige

Normally, debt is the main issue most households face

Image credits: Towfiqu barbhuiya / Unsplash (not the actual photo)

Those familiar with Dave Ramsey’s work and philosophy shouldn’t be surprised that the very first thing he asks about is debt. Indeed, a large part of his personal story and philosophy focuses on the “debt snowball method,” where, assuming a person has debt from multiple sources, you pay off the smallest one first and work your way “up.”

While this particular caller does have five figures of debt, it doesn’t appear like it’s a particular issue for him or his family. After all, he pays his entire college debt, per year, per head for childcare. Most people would look at a joint income of $180,000 and relatively minimal debt and wonder what difficulties this family could ever be going through.

Adding in the extra costs and a nanny during the summer, this family is spending what could amount to a solid annual income just on childcare, never mind all the other costs of actually having a kid. Naturally, Dave Ramsey suggests that they downgrade the daycare they use, which, for some reason, prompted a lot of quite negative comments.

Childcare costs have been steadily increasing, although people without kids might not have noticed

Image credits: Aaron Burden / Unsplash (not the actual photo)

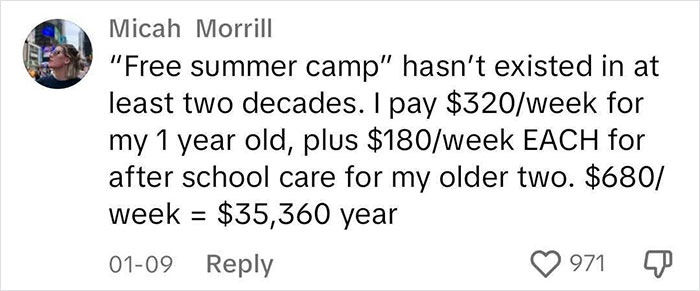

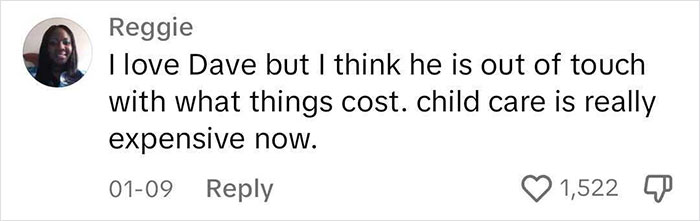

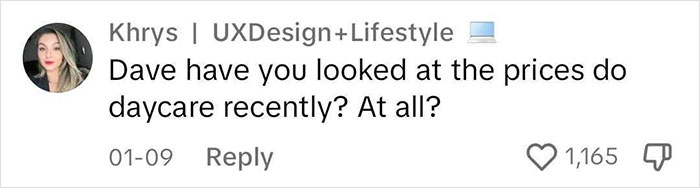

There is some partial truth to this. Childcare costs have been steadily increasing, although this information is rarely front and center anymore, as childless folks will often not have any idea it’s happening in the first place. Similarly, not all people with children employ professional childcare, they might offload the task to family or have state-sponsored alternatives.

One study revealed that, on average, Americans spend around $1700 a month per child. This is no small sum, although still half of what the caller spends on a single child per month. What is more surprising is the fact that so many viewers didn’t seem to even blink. Instead, they call Dave Ramsey out of touch for thinking this is way too much.

It’s true that a person purporting to give financial advice should be informed about the costs people face on a daily basis. However, this particular caller, on top of paying for a summer nanny, is spending over twice the national average per month for each child. Given that many daycares do give discounts for additional children, it’s unclear why he can’t just find a cheaper alternative.

There are alternatives to daycare

As other comments note, given the money he is spending, a full-time, year-round, live-in nanny could do the trick. Since we don’t know the caller’s housing situation, this isn’t necessarily the silver bullet he is looking for. After all, a nanny needs to be housed, he or she will still take holidays, it might make work from home more stressful and who knows what else.

At the same time, we do know that the caller does hire a nanny over the summer, so his household must have the capacity to house one. The real issue here is that, even at higher economic levels, one has to evaluate cost opportunities. If the daycare suits his lifestyle, then perhaps the cost makes sense. However, if it’s too expensive, he might have to live a bit less comfortably to save, the kind of decision all of us are making nearly every single day.

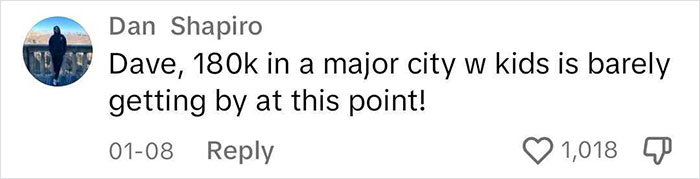

Viewers debated the rising costs of childcare and Dave’s advice