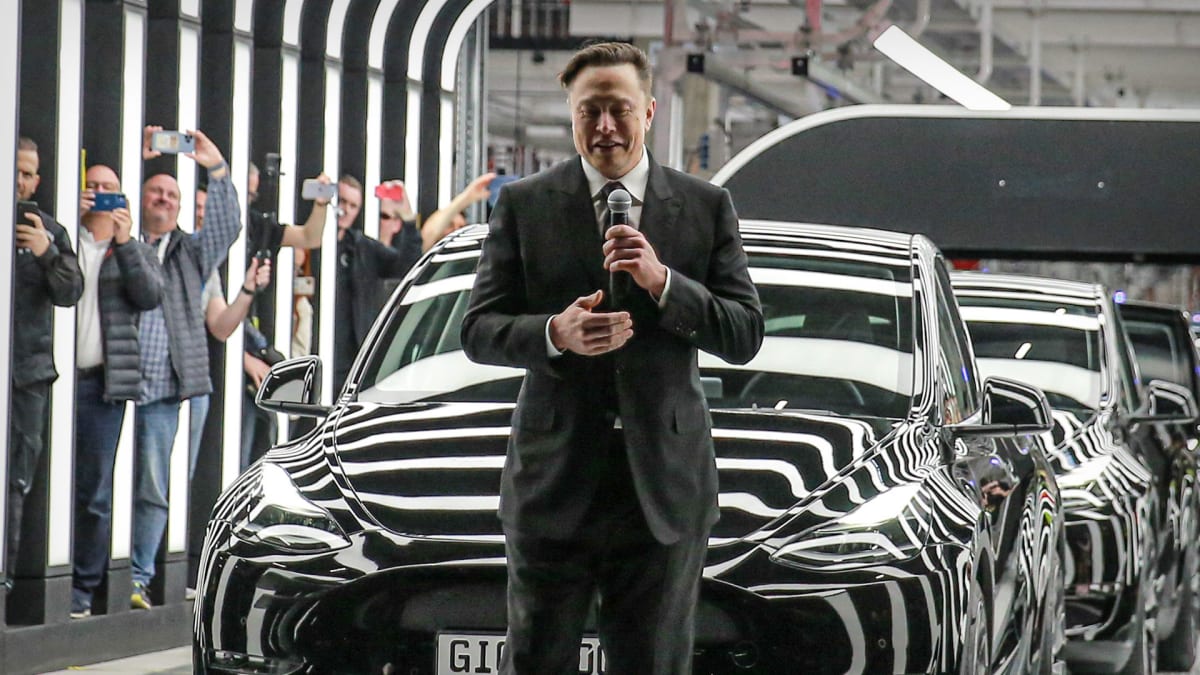

Elon Musk has surprised the global financial community in recent months by slashing the prices of Tesla cars.

For the first time in many years the manufacturer of electric vehicles has altered its image of catering to urban consumers and people with large purchasing power by reducing its prices six times in just three months.

A Tesla car now sells for less than $40,000 at the base price. The Model 3 rear-wheel drive is base-priced at $39,990, according to the carmaker's website.

The Model Y SUV, the world's most popular electric vehicle by sales in 2022, can be purchased in the U.S. for $39,490, once the buyer deducts the $7,500 federal tax credit under the Inflation Reduction Act.

Tesla Making Cars More Affordable

As a result, Tesla (TSLA) for the first time finds itself competing to win over average consumers, those who hesitate to buy an EV because the prices are prohibitive.

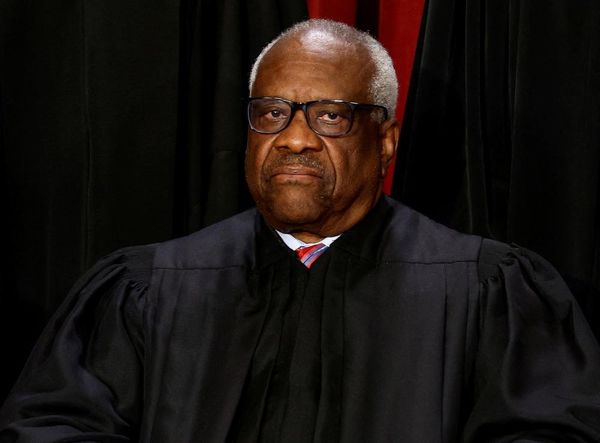

The billionaire entrepreneur defended this unprecedented pricing policy, explaining that in the current economic environment the goal was to make Tesla cars affordable to as many people as possible.

"We've taken a view that pushing for higher volumes and a larger fleet is the right choice here versus a lower volume and higher margin," Musk told analysts and investors during Tesla’s first-quarter-earnings’ call on April 19.

He said he would be comfortable with a relatively thin initial margin.

"If the [Federal Reserve] were to lower the rates, that would be super helpful for demand. If it isn't, that just raises the interest cost that buyers have to pay to buy a car," Musk said.

"I can't emphasize enough the just fundamental question of affordability for most people. Their ability to buy a car is a function of can they make monthly payments or not? And if interest rates are really high, like they're all right now, then in some cases people can't get a loan at all."

This explanation disappointed investors, who were concerned that Tesla's profit margins would shrink. A few days later, Musk shone the light on the new reality for potential car buyers. This hard talk confirms and reinforces Tesla's decision to lower prices.

Banks, says Musk, are now reluctant to provide car loans because they themselves are facing a crisis of confidence from investors, who have questioned their soundness since Silicon Valley Bank failed on March 10. Most banks seek to limit their risks as much as possible and preserve their liquidity.

'It's Harder to Get Car Loans': Elon Musk

"It is becoming harder for people to get car loans in the US, even when their credit is good,” Musk lamented on April 30. "Understandable that banks are slow to extend credit when they're trying to avoid bankruptcy themselves!”

The CEO's tweet followed a post from a user showing that only 13,528 Toyota (TM) Corollas were sold in March in the US. That's the worst March sales figure for Toyota's popular model since it was introduced to the U.S. market.

Average interest rates for new car loans went from 4.4% in February 2022 to 7% in February 2023, according to Edmunds.com. Average interest rates for used-car loans went from 7.8% in February 2022 to 11.3% in February 2023.

"Now that the auto industry is recovering from the supply shortage and inventory is improving, vehicle prices should soften, which should also provide relief to those who cannot wait any longer to purchase,” said Jessica Caldwell, Edmunds’ executive director of insights.

"But that is only one factor of the equation — since most car buyers need a loan, another increase in interest rates will only continue to hinder what has already become a very expensive proposition.”

She added that a potential light at the end of the tunnel for car shoppers could come in the form of financial incentives from auto manufacturers as vehicles sit longer on dealer lots and inventory builds up.

But shoppers, warned Caldwell, can’t expect the "doorbuster bargains” they saw prepandemic.

"Consumers with good credit who do their research might find more favorable financing options heading into the summer season,” the expert said.

Forget Tesla -- Find Out Why We're All in on This EV Stock