Saving enough money for a solid down payment on a home is one of the biggest financial challenges many people face.

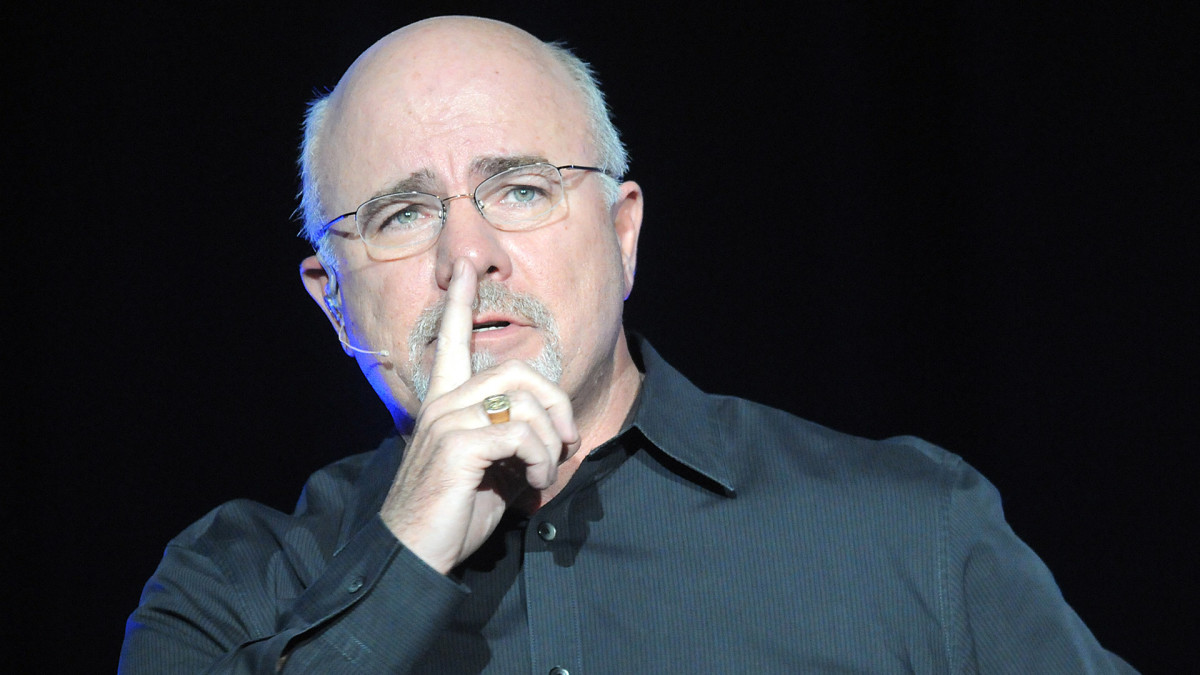

But personal finance coach Dave Ramsey encourages potential homebuyers to be careful about a sometimes tempting option.

Related: Another company files for bankruptcy and Dave Ramsey has words

A number of people considering buying a home wonder whether tapping into their 401(k) to help put together the cash for a down payment might be a worthwhile creative solution.

Ramsey has some words about that idea, saying that the concept is tempting, but that it is not a good choice to make in the long term.

The personal finance radio host thinks a decision such as this might have the potential to turn one's American dream into a nightmare.

And Ramsey goes into some detail to explain a few reasons why.

Dave Ramsey urges people to consider whether they are ready to own a home

If a person is struggling to find a way to make a down payment on a home, that might be a clue to where they are financially in the first place.

"If you're so strapped for money while saving for a home down payment that you need to borrow from your 401(k), you're not ready to be a homeowner," wrote Ramsey Solutions. "Think about it: After closing on a house, homeowners need margin in their budget to cover mortgage payments, larger utility bills, home maintenance costs, and even unexpected repairs that could pop up at any time."

Ramsey also mentioned the penalties that are involved when people take money out of a 401(k).

"Pulling money out of your 401(k) means stealing from your future retirement in more ways than one," Ramsey Solutions wrote. "For example, an early 401(k) withdrawal comes with hefty penalty fees and taxes. In fact, you could lose a third of your nest egg before you even get to spend it!"

TheStreet

Ramsey warns that there is more financial damage involved

The host of the The Ramsey Show talked a bit about other financial opportunities that can be lost when borrowing from a 401(k).

"The damage doesn't stop there," Ramsey wrote. "The worst part of taking money out of your 401(k) to buy a house is losing the long-term growth on the money you stashed away for your retirement."

"Compound growth is a wonderful thing, and it's what turns a few thousand dollars' worth of contributions from you and your employer into millions over time," he continued. "Taking that money out of your 401(k) means you're unplugging it from that potential. And you'll lose out on some serious money in the long run."

Ramsey was very blunt in a statement emphasizing these points.

"We'll give it to you straight: You should never, ever take money out of your 401(k) to buy a house. Period," he wrote. "If you don't have enough money saved for a down payment, you're not ready to own a house."

"So, if you've got the house fever: Cool off, grab a cold shower, and take a real, honest look at where you are financially," Ramsey continued. "There's plenty of time and better ways to save up for a down payment.

Related: Veteran fund manager picks favorite stocks for 2024