The current crisis in the banking industry can be blamed on a few black sheep that failed to properly manage risk rather than broader troubles in the system as a whole, the boss of Citigroup argued.

Jane Fraser, CEO of the third largest U.S. bank by assets, dismissed speculation the sector could see a repeat of the 2008 global financial meltdown.

Instead, this month's collapse of lenders Silicon Valley Bank and Credit Suisse were merely isolated examples of individual incompetence rather than canaries in the coal mine.

“This is not something that is spread across the entire banking system. This isn’t like it was last time,” she said on Wednesday in an interview conducted by David Rubinstein, head of private equity firm Carlyle Group.

“This is not a credit crisis. This is a situation where it’s a few banks that have some problems, and it’s better to make sure that we nip that in the bud.”

Silicon Valley Bank mismanaged its balance sheet, in her opinion, while amassing an unhealthy concentration of cash-burning depositors. Credit Suisse meanwhile fell victim to its own string of scandals.

“We’re talking about three or four banks out of thousands,” Fraser argued.

She did not rule out the very real possibility that a few smaller lenders may either fail or seek refuge in a shotgun wedding with a rival but described the risks as manageable.

Technology changing the dynamics of modern-day bank runs

Asked why she would join forces with ten other banks to deposit en masse $30 billion into ailing San Francisco lender First Republic Bank last Thursday, Fraser said the move was naturally motivated by collective self-interest.

“You don’t put $5 billion into the system through the generosity of your own heart,” she said. “We want to stop what could have been a problem, and we all know when there is a confidence crisis, the logic that takes over isn’t necessarily rational.”

While SVB and Credit Suisse had to shoulder the blame for their own demise, in her opinion, there was one factor that management could not have fully anticipated.

Thanks to modern smartphone-enabled payments technology and the viral rate at which panic can spread via social media, bank runs can now occur at blinding speeds that overwhelm a lender.

“It’s a complete game changer from what we’ve seen before,” Fraser said. “There were a couple of tweets and then this thing went down much faster than has happened in history.”

Fraser defends beleaguered Fed chief Jay Powell

Despite the current fashion to blame the Federal Reserve for the current crisis, Fraser gave good marks to Fed chair Jerome ‘Jay’ Powell.

“In Jay the markets trust, and many of us do, because he has been so clear about slaying the inflation dragon,” the native Scot said, calling his justification on Wednesday for another quarter-point rate hike “jolly sensible”.

Billionaire entrepreneur Elon Musk, whose tech companies have been a chief recipient of capital thanks to the previous ultra-low rate environment, found quite different words.

On Wednesday, the CEO of Tesla, Twitter and SpaceX called the tighter policy a “foolish” decision that would further hasten depositor flight, adding artificial intelligence “couldn’t do [a] worse” job than Powell.

Citi is hoping to bolster its own languishing stock

Part of the reason for the panic that engulfed SVB and Credit Suisse stemmed from a swift and brutal drop in their share prices, a signal of just how quickly investors lost confidence.

Rubinstein pressed Fraser on Citi’s own repeated failure to convince the bank’s equity holders of its strategy.

The stock has been languishing around the same level it sunk to in 2009 following the global financial crisis for more than a decade. Since Fraser took the reins in February 2021 as the first female CEO of a major U.S. bank, it has actually dropped by a quarter.

The Citi boss explained her institute was in the process of redirecting its focus by divesting non-core activities. In the process, she said 65,000 workers—approximately every fourth Citigroup employee—would find new employers as a result.

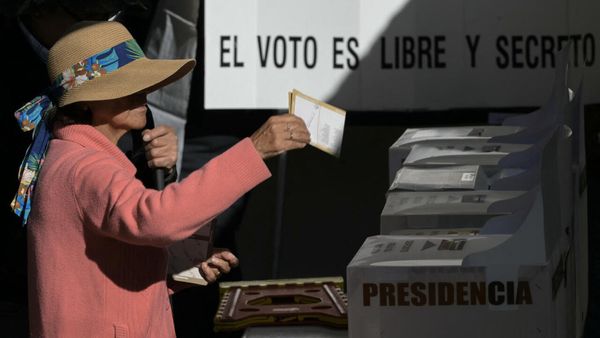

One example is the pending sale of Citibanamex in Mexico, which, once finalized, will mark the complete withdrawal from its retail banking operations abroad. Fraser wants to then redouble efforts to serve its global corporate clients.

“We will move every single day $4 trillion of volume for 5,000 multinational firms,” she said. “There’s no other bank in the world that can do that.”