After posting mixed third-quarter results Wednesday, retail investment platform Robinhood's stock fell by about 14%. The decline seems largely to do with the news that Robinhood's trading volumes and monthly active users fell for the quarter.

Still, Robinhood HOOD beat Street expectations, posting a net loss of $85 million, or nine cents per share, compared to the net loss of 20 cents per share the company reported in the year-ago period.

Despite the fact that Robinhood posted revenue of $467 million for the quarter, a 29% year-over-year increase, the number still came in below Street expectations of $480 million, a revenue miss that did not help investor sentiment.

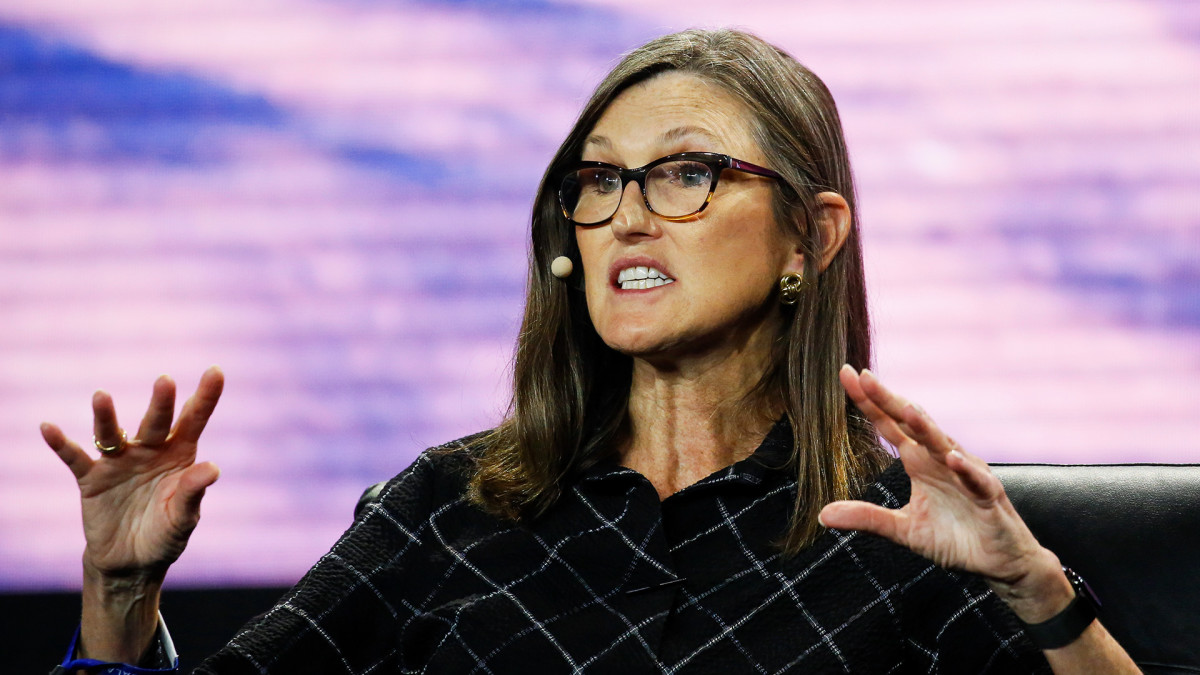

Related: Cathie Wood has a blunt warning about Tesla's stock over the coming months

Net interest revenues, the company said, increased nearly 100% year-over-year, while transaction-based revenues fell by 11%. The firm's monthly active users fell more than 16% year-over-year to 10.3 million, but average revenue per user jumped by 27% to $80.

“It's been nearly 10 years since we founded Robinhood and we're just getting started," CEO Vlad Tenev said in a statement. “Looking ahead, we remain focused on providing industry-leading products that serve far more of customers’ financial needs, gaining market share, expanding internationally, and continuing to change the industry for the better.”

Robinhood said that it will "soon launch" operations in the U.K.; soon after this global expansion, the company plans to launch crypto trading in the European Union.

The heavy stock slide, to Cathie Wood of Ark Invest, represented little more than an opportunity to boost her holding in one of Ark's favorite companies.

Ark Invest picked up a total of 1,141,046 shares of Robinhood Nov. 8, a purchase that was worth slightly less than $10 million based on its closing price of $8.37. The bulk of the purchase was made by Ark's flagship Innovation ETF, which snapped up 888,500 shares in the company; Ark's Next Generation Internet and Fintech ETFs acquired the remainder.

The purchase boosted Ark Innovation's Robinhood holding above 21 million shares, worth more than $177 million and weighted at only 2.54% of the fund. The ETF is currently dominated by Ark's holdings in Coinbase COIN, Roku ROKU and Tesla TSLA.

Shares of Robinhood, now up only 2.7% for the year, ticked up about 2% in pre-market trading.

Related: Cathie Wood pulls $14 million out of soaring software giant

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.