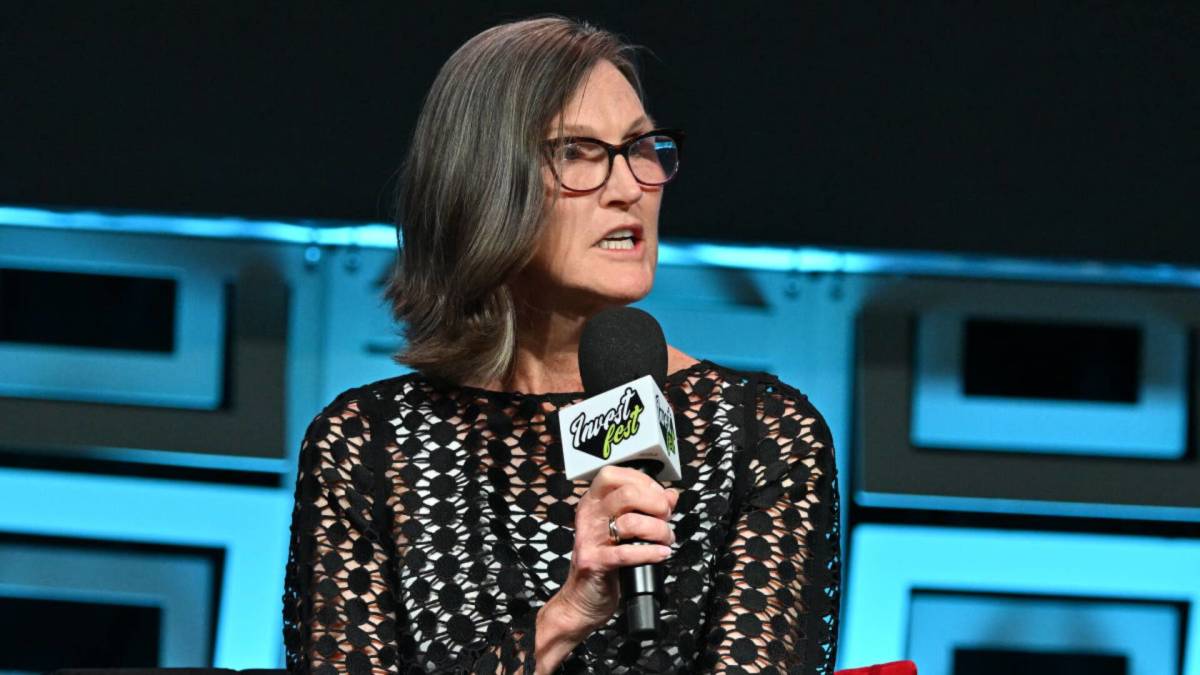

Despite the problems that have plagued the cryptocurrency sector over the past year — notably, the implosion of FTX and the recent $4 billion Binance settlement — Cathie Wood, CEO and investment lead of Ark Invest, has remained incredibly bullish on cryptocurrencies.

“Last year, a lot of people thought that the bankruptcy of FTX, Celsius and Three Arrows was going to be the end of bitcoin. And quite the opposite happened,” Wood told Benzinga in August.

Bitcoin's price on Monday broke $40,000 for the first time in 18 months. The largest cryptocurrency was sitting at around $44,000 Wednesday morning, a sharp increase over the past year.

Related: Cathie Wood explains why Tesla Chief Elon Musk is worth betting so much on

Even after the surge, is still 57% away from its high of $69,000, set in 2021.

Hopes for regulators to approve bitcoin ETFs

The surge stems at least in part from signs that several major investment firms — including BlackRock and Fidelity — are close to receiving regulatory approval to offer spot bitcoin exchange-traded funds. Ark Invest is among those firms that have applied for approval.

Wood told CNBC last month: "Hopes are rising that a number of bitcoin ETFs will be approved."

In August, Wood called bitcoin a "hedge against both inflation and deflation because there’s no counterparty risk, and institutions are barely involved."

"It’s digital gold," she said.

Related: Meet the biotech company Cathie Wood bought half a million shares of this month

In the wake of the surge, Ark Invest on Tuesday sold a total of 237,572 shares of Coinbase (COIN) -) Global, a popular crypto trading platform. The sale was valued at roughly $33.3 million.

Ark's flagship Innovation ETF was responsible for the bulk of the sale, trimming 201,711 shares of its Coinbase holding, which recently became the fund's largest position.

Even after the trim, Ark Innovation's Coinbase holding — weighted at 11.64% of the fund — remains its largest holding, valued at $960 million.

Coinbase stock has moved up sharply

Shares of Coinbase have about quadrupled this year and nearly doubled in the past month alone. The stock closed Tuesday at $140.20.

Wood has said that when one holding spikes relative to its other names, Ark will always sell some of the larger holding and redistribute that into other companies.

"We will always recycle that way," she said.

Reporting third-quarter results last month, Coinbase posted a net loss on $674 million in revenue. The firm told investors that it was on track to deliver "meaningful positive adjusted Ebitda for 2023."

Many investors, however, remain skeptical of bitcoin and crypto.

The late Charlie Munger, who served as Berkshire Hathaway's vice chairman, earlier this year called crypto "absolutely crazy, stupid gambling.”

“I don't welcome a currency that's so useful to kidnappers and extortionists and so forth," Munger said in 2021. "Nor do I like shuffling out a few extra billions and billions of dollars to somebody who just invented a new financial product out of thin air.”

Ark's Next Generation Internet ETF additionally sold 168,127 shares of its holding in Bitcoin Investment Trust.

Related: Cathie Wood snaps up 90,000 shares of a stock that just fell 27% in one day

Get exclusive access to portfolio managers’ stock picks and proven investing strategies with Real Money Pro. Get started now.