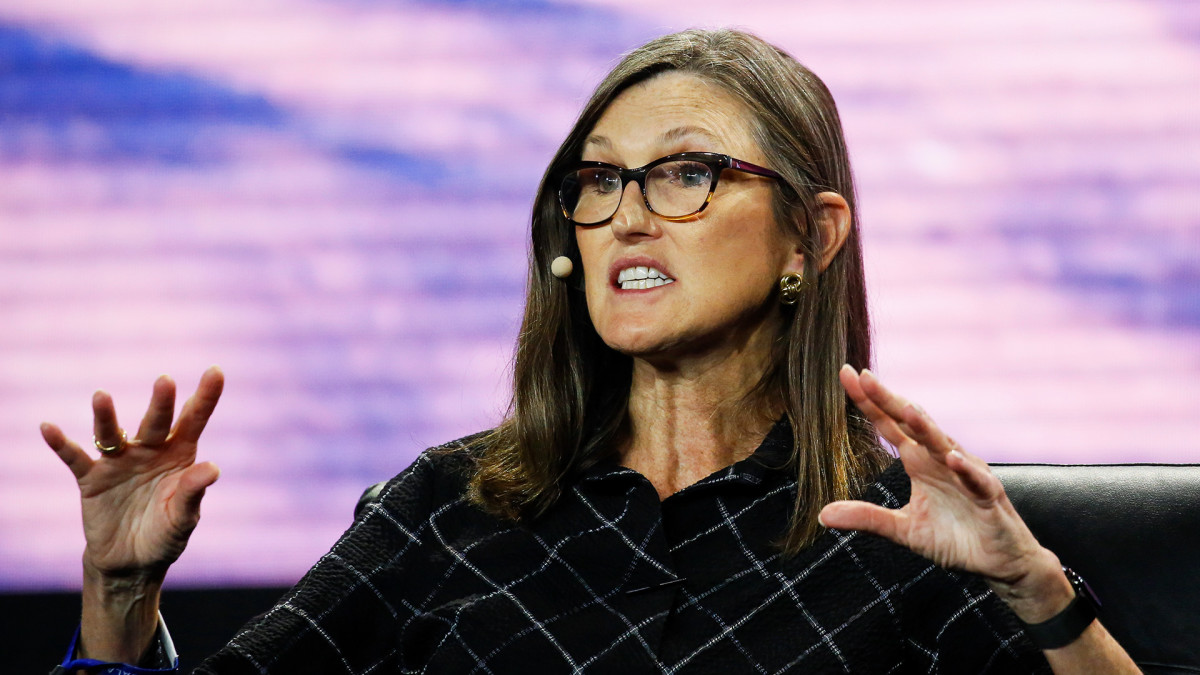

Not many investors knew who Cathie Wood was five years ago. But plenty know who the head of Ark Investment Management is now.

Known to her devotees as Mama Cathie, Wood rocketed to prominence thanks to a stupendous return of 153% in 2020 and clear presentations of her investment philosophy in ubiquitous media appearances.

But her longer-term returns are less stellar. Wood’s flagship Ark Innovation ETF (ARKK) , with $7.9 billion in assets, has generated a respectable return of 33% for the past 12 months, matching the S&P 500.

But Ark Innovation’s annualized return is negative 24% for the past three years and a mere positive 2% for five years.

That’s nothing to brag about, as the S&P 500 posted positive returns of 12% for three years and 15% for five years. Wood’s goal is for at least 15% annual returns over five-year periods.

PATRICK T. FALLON/AFP via Getty Images

Cathie Wood’s Investment Philosophy

Her investment strategy isn’t hard to fathom. Ark’s ETFs generally buy young, small-company stocks in the high-tech categories of artificial intelligence, blockchain, DNA sequencing, energy storage, and robotics. She views those areas as game changers for the global economy.

Related: Cathie Wood trades almost $100 million of 2 big tech stocks

These stocks are quite volatile, of course, so the Ark funds are subject to rollercoaster rides. And Wood frequently trades in and out of her top names.

Investment research titan Morningstar is quite critical of Wood and Ark Innovation ETF. “ARK Innovation has dubious ability to successfully navigate the challenging territory it explores,” Morningstar analyst Robby Greengold wrote last year.

The potential of Wood’s five high-tech platforms listed above is “compelling,” he said. “But Ark’s ability to spot the winners among them and navigate their myriad risks is less so. The strategy’s booms and busts have culminated in middling total returns and extreme volatility since its 2014 inception.”

It’s not an investment 101 portfolio. “The strategy narrowly invests in stocks with paltry current earnings, elevated valuations, and highly correlated stock prices,” Greengold said. “Their extreme volatility underscores their highly uncertain futures.”

Wood has defended herself from Morningstar’s criticism. “I do know there are companies like that one [Morningstar] that do not understand what we're doing,” she told Magnifi Media by Tifin in 2022.

“We do not fit into their style boxes. And I think style boxes will become a thing of the past, as technology blurs the lines between and among sectors.”

But some of Wood’s customers apparently agree with Morningstar. During Ark Innovation’s rally of the past 12 months, it saw a net investment outflow of $1.7 billion.

Cathie Wood’s recent buys and sells

On Friday and Monday, Ark funds bought a combined 279,829 shares of electric-car titan Tesla (TSLA) , valued at $78.3 million as of Monday’s close.

Fund manager buys and sells:

- $7 billion fund manager touts 3 blue-chip stocks

- Cathie Wood buys $35 million of beaten-down tech stock

- Single Best Trade: Fund manager at $7 billion firm unveils favorite pick

Tesla shares have dropped 27% year to date amid sluggish sales growth and Chief Executive Elon Musk’s erratic behavior.

The EV automaker reportedly downshifted production in China recently because of lower EV sales growth, and fourth-quarter sales only increased 3% year-over-year to $25.2 billion.

Nevertheless, Wood has regularly expressed admiration for Musk and his mission to promote nonpolluting cars. Tesla represents the second biggest holding in Ark Innovation.

On Friday, Ark Funds continued their recent purchases of social media giant Meta Platforms (META) , owner of Facebook and Instagram. Friday’s haul was 24,917 shares, valued at $12.7 million as of that day’s close.

Now might seem like an odd time to load up on Meta, given that the stock has already doubled over the past year. But much of that increase stems from investor enthusiasm over artificial intelligence – a focus point for Meta. And Wood shares that enthusiasm.

On Friday and Monday, Ark funds sold a combined 291,901 shares of Coinbase Global (COIN) , the country’s biggest cryptocurrency exchange. That kitty was valued at $81.6 million as of Monday’s close.

Coinbase stock has quadrupled over the past 12 months amid the surge in bitcoin and other cryptocurrencies. So Wood may feel now is a good time to take profits. Coinbase remains the biggest holding by far in Ark Innovation ETF.

Finally, on Friday and Monday Ark funds dumped a combined 402,597 shares of online sports gambling stalwart DraftKings (DKNG) , valued at $19.1 million as of Monday’s close.

The stock has almost tripled over the past year amid the explosion in sports gambling. So again, Wood may have been taking profits. DraftKings remains the 11th biggest holding in Ark Innovation.

Related: Veteran fund manager picks favorite stocks for 2024