As the virus that causes Covid-19 spread around the world in 2020, it harmed many people's health and economic well-being. Some major businesses ended up filing for bankruptcy.

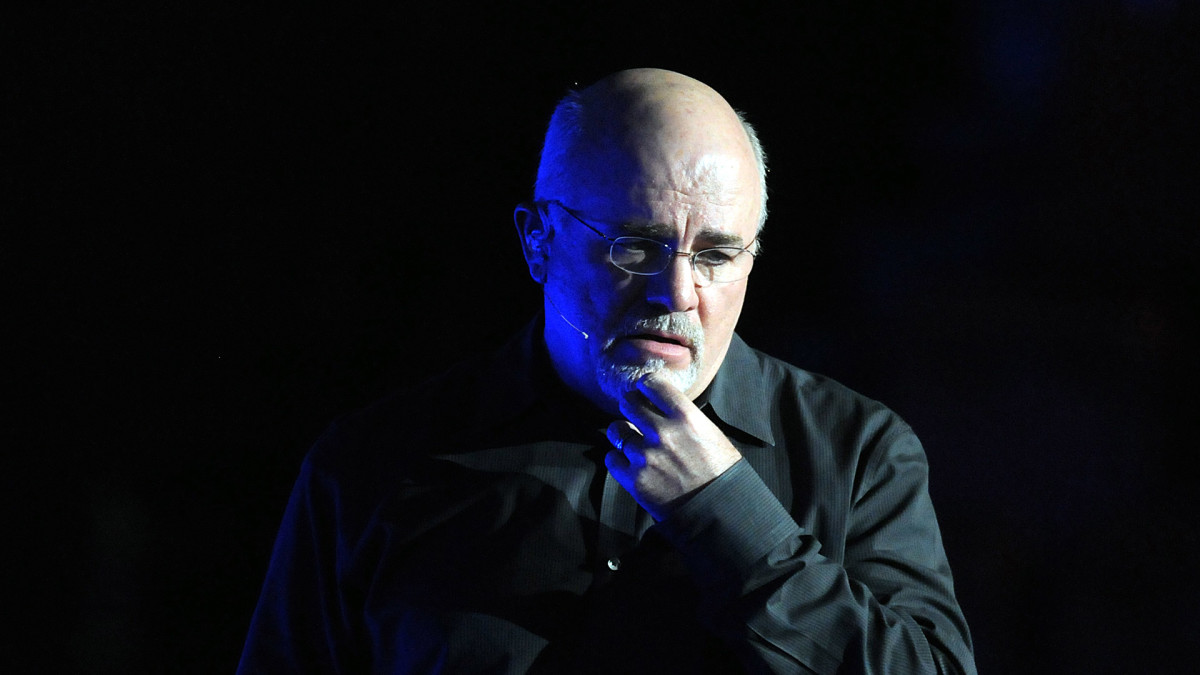

Whether it's a business or an individual that is forced to make the move, bestselling author and radio host Dave Ramsey stresses that it's a tough decision to make — and even bankruptcy lawyers call the process a last resort.

Related: Iconic movie theater chain files for Chapter 11 bankruptcy

Many types of businesses were affected by the pandemic: Airlines, hotels, restaurants and retail were some of the hardest hit.

Because the pandemic caused people to stay at home and away from others, any business that relied on public gatherings suffered as well. And this included movie theatres.

In fact, movie theatre company Cineworld — the Regal Cinemas owner — filed for bankruptcy in September 2022. The company eventually came out of bankruptcy on July 31, 2023.

More recently, Los Angeles-based movie theatre chain Metropolitan Theatres Corp. filed for Chapter 11 bankruptcy protection on Feb. 29.

Dave Ramsey explains another type of bankruptcy

Bankruptcy allows for both businesses and individuals to clean their books by getting rid of debt that would likely never be paid.

There are some nuances, but generally speaking, a business can file for Chapter 7 bankruptcy if it's ready to close its companies. Businesses that are prepared to restructure their debt and keep operating can file Chapter 11 bankruptcy.

Individuals who can't repay their debts because they have too little income or too many expenses can file using Chapter 7. Chapter 13 can be used by individuals who are earning incomes and are in enough financial good shape to pay an amount to creditors with a payment plan.

Personal finance media personality Dave Ramsey filed for bankruptcy in 1988 at 26 years old. He was worth more than $1 million, but he was involved in real estate deals that left him with a lot of short-term debt.

As banks began asking for loans to be paid back, Ramsey found himself in financial trouble and ultimately lost everything.

He now runs a successful business, writes books, speaks and hosts a popular radio show and podcast.

"Wherever you're at with your money, you can get through it," he wrote on the Ramsey Solutions website. "At one point or another, every successful person has failed — but instead of being defined by it, they learned from it. That's how you win."

Shutterstock

Ramsey suggests ways to avoid bankruptcy

The Ramsey Show host understands that individuals who are trying to emerge from debt are usually trying to avoid bankruptcy and only file for it as a final option if nothing else were to work.

He offers a few steps to follow in an effort to fend it off.

Ramsey advises people to focus first on what he calls the "four walls." These are food, utilities, shelter and transportation.

"Don't pay anyone else until these basics are covered," he wrote. "Keep the family fed, the lights on, the rent or mortgage paid, and the gas tank full enough to get you to work."

He also suggests people sell anything they can that they don't need — and to live on a tight budget that includes eating inexpensive generic food such as beans and rice and never going on vacations or even out to dinner.

Another way to avoid bankruptcy is to find an extra source of income, which often means getting a second (or third) job, Ramsey said. He added that it's important for people going through this to remember that the situation is only temporary.

Ramsey also recommends that people see a financial advisor or coach, and that they be wary of any companies offering to bail them out with predatory debt consolidation schemes.

Related: Veteran fund manager picks favorite stocks for 2024