The famous shipping magnate Aristotle Onassis once said, "We must learn to sail in high winds.”

That's a piece of advice that can be applied far beyond the seven seas and the ocean blue.

Related: Analysts revise AMD stock price targets after earnings shock

To survive, companies must learn to navigate some extremely unforgiving waters, as they look to make a profit and dodge treacherous waves of red ink.

Okay, that's enough of the salty sea dog talk. Let's get down to business.

It's earnings season, and the world, as we know, is currently being overhauled by artificial intelligence.

Companies have been spending a lot of money to get a seat at the AI table and Super Micro Computer (SMCI) , which makes high-end servers used in artificial intelligence, has benefited big-time from that spending.

The San Jose, Calif.-based company has a long history of building top-shelf rack servers, storage systems, and other similar solutions for data centers.

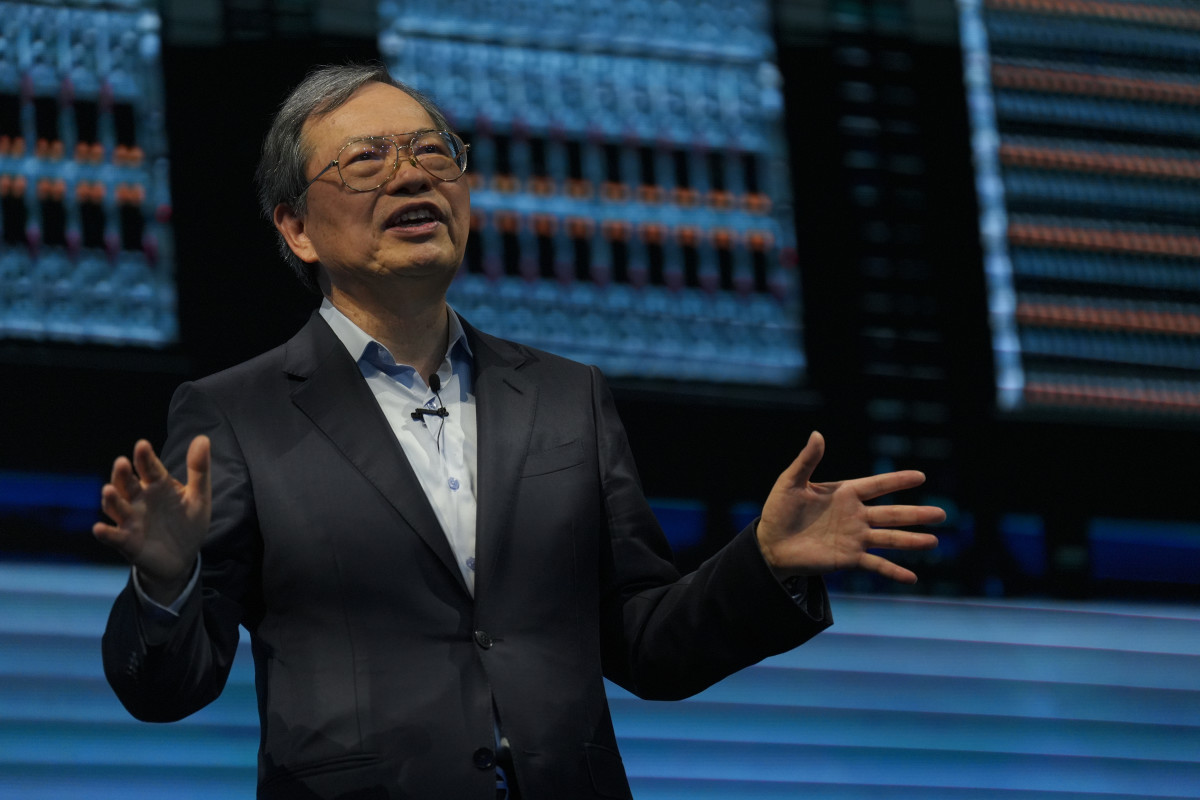

The company, whose shares have soared with the AI explosion, reported third-quarter earnings on April 30. CEO Charles Liang, who co-founded Super Micro with his wife in 1993, expressed confidence about the future.

“Super Micro is at the forefront of the current AI revolution,” Liang told analysts during the company’s earnings call. “These strong results reflect the continued demand for our rack-scale plug-and-play total AI solutions.”

Super Micro Computer faces supply chain challenges

Liang said that SuperMicro continued to face supply chain challenges due to new products that require new key components, especially DLC or Direct Liquid Cooling-related components, and he believes this situation will gradually improve in the coming quarters.

“To sustain this rapid growth, we are making significant investments in production, operation, management software, cloud features, and customer service to further increase our customer base and bring more value to them,” he said.

Related: Analyst revamps Nvidia stock price target ahead of earnings

Super Micro earned $6.65 per share, up from $1.63 per share in the year-ago quarter, beating the FactSet consensus of $5.74 per share.

Revenue totaled $3.85 billion, up from $1.28 billion a year ago, but it fell short of FactSet's call for $3.95 billion.

Looking ahead, SuperMicro expects to earn $7.62 to $8.42 per share in the fourth quarter on revenue of S5.1 billion to $5.5 billion. FactSet is forecasting earnings of $7.94 per share on $5.2 billion in sales.

The computer hardware company also raised its 2024 revenue guidance to $14.7 billion to $15.1 billion from $14.3 billion to $14.7 billion. FactSet's consensus calls for $14.81 billion in sales.

However, investors apparently were not pleased with what they heard, and Super Micro's shares finished down some 14% to $738.30 on May 1.

TheStreet Pro's Bruce Kamich, who warned investors to "keep your powder dry" several weeks ago, said, "The broad market averages are in a 'risk off' mode and I suspect that will impact stocks like SMCI. Avoid the long side of SMCI as further declines are likely."

Analysts who cover Super Micro adjusted their price targets after the earnings announcement.

Barclay’s analyst George Wang boosted his price target on Supermicro to $1,000 from $961, while keeping an overweight rating on the shares.

He told investors that the company reported a strong June quarter revenue guide. The next two quarters are expected to grow sequentially due to improving supply and artificial intelligence tailwinds.

Analyst cites 'strongest moat'

“We continue to highlight time to market as the strongest moat for SMCI,” said Wang, who made a similar observation back in March. “We think the AI strength is still in the early innings, and it's too early to take a cautious view at this point.”

The analyst said that as Nvidia (NVDA) increases the new product launch cadence, to once a year right now compared with once every other year in the past, "it should structurally increase Super Micro's advantage, as it will have a list of matching products ready immediately and offer design assistance after Nvidia, Advanced Micro Devices (AMD) , and Intel (INTC) announce a new silicon product, compared with a much longer development cycle for competitors."

More AI Stocks:

- Analyst unveils eye-popping Palantir stock price target after Oracle deal

- Veteran analyst delivers blunt warning about Nvidia's stock

- Analysts revamp Microsoft stock price target amid OpenAI reports

Wedbush analyst Matt Bryson raised the firm's price target on Supermicro to $800 from $530 and kept a neutral rating on the shares.

Bryson noted that Supermicro guided revenues for the year meaningfully higher, suggesting sales momentum is only accelerating into the fourth quarter.

At the same time, he said the midpoint of management's guidance implicitly suggests gross margin deterioration of about 200 basis points and an operating margin decline of about 100 bps.

Bryson also pointed out that the expected margin dip, in turn, necessarily ref concerns about how competition might weigh on Super Micro's ability to translate AI-related server growth into profit, both in the current quarter and moving forward.

Bank of America Securities analysts cut their price target on Super Micro to $1,090 from $1,280 while reiterating their buy rating. The company “remains a pure play AI server vendor, and we expect continued positive estimate revisions in the long term.”

Super Micro gave a strong revenue guidance for the fourth quarter, BofA said, but the guidance implies gross margin lower than the long-term range.

"While cash burn in the quarter was high, we note that a significant part of this was driven by increased inventory, which we view as transitory," the firm said.

Wells Fargo analysts also lowered the firm's price target on Supermicro to $890 from $960 while keeping an equal weight rating on the shares.

The firm sees the selloff as reflective of increased valuation sensitivity as gross margin percentage scrutiny comes into focus.

Related: Veteran fund manager picks favorite stocks for 2024