Affirm Holdings Inc (NASDAQ:AFRM) shares have been slaughtered since the "buy now, pay later" company officially released its fiscal second-quarter financial results Thursday afternoon.

What Happened: The stock initially surged higher when the company highlighted some of its quarterly results via tweet shortly before an official press release was issued. That tweet turned out to be an accidental release and the result of "human error," according to Affirm.

Due to human error, a small portion of Affirm’s fiscal Q2 results were inadvertently tweeted from Affirm’s official Twitter account earlier today. Affirm has since issued its complete fiscal Q2 results, which are available at https://t.co/kQLTu8O9Vv.

— Affirm (@Affirm) February 10, 2022

Affirm said quarterly revenue increased 77% year-over-year to $361 million, which beat the $328.8 million estimate. The company reported a quarterly earnings loss of 57 cents per share versus the expected loss of 37 cents per share.

Affirm also guided for lower revenue in the first quarter, which seemed to add fuel to the sell-off.

See Also: Why Affirm Shares Are Falling

Why It Matters: Affirm CEO Max Levchin explained that not all of the company's merchant deals are the same.

"Different products that we sell to merchants have different profitability profiles and different recognition of revenue," Levchin said Friday on CNBC's "TechCheck."

Affirm derives revenue from some of its transactions on the spot, while others accrue slowly based on interest, he said. The company is becoming increasingly more focused on the latter, which means revenue may take longer to become recognized.

"Over time it will of course normalize because ultimately the same dollars of revenue will come in," Levchin said, stressing that such is an important aspect of the business investors need to understand.

"You will see it play out very well over the next several quarters," he told CNBC.

Levchin highlighted that Affirm's active user base increased 150% year-over-year and the frequency of transactions increased with it.

"These are a huge number of new users we're adding, so they only really had a chance to transact just once and yet, the transaction per user number is also up," Levchin emphasized.

AFRM Price Action: Affirm has traded as low as $45.88 and as high as $176.65 over a 52-week period.

The stock was down 21.49% at $46.07 Friday afternoon at publication.

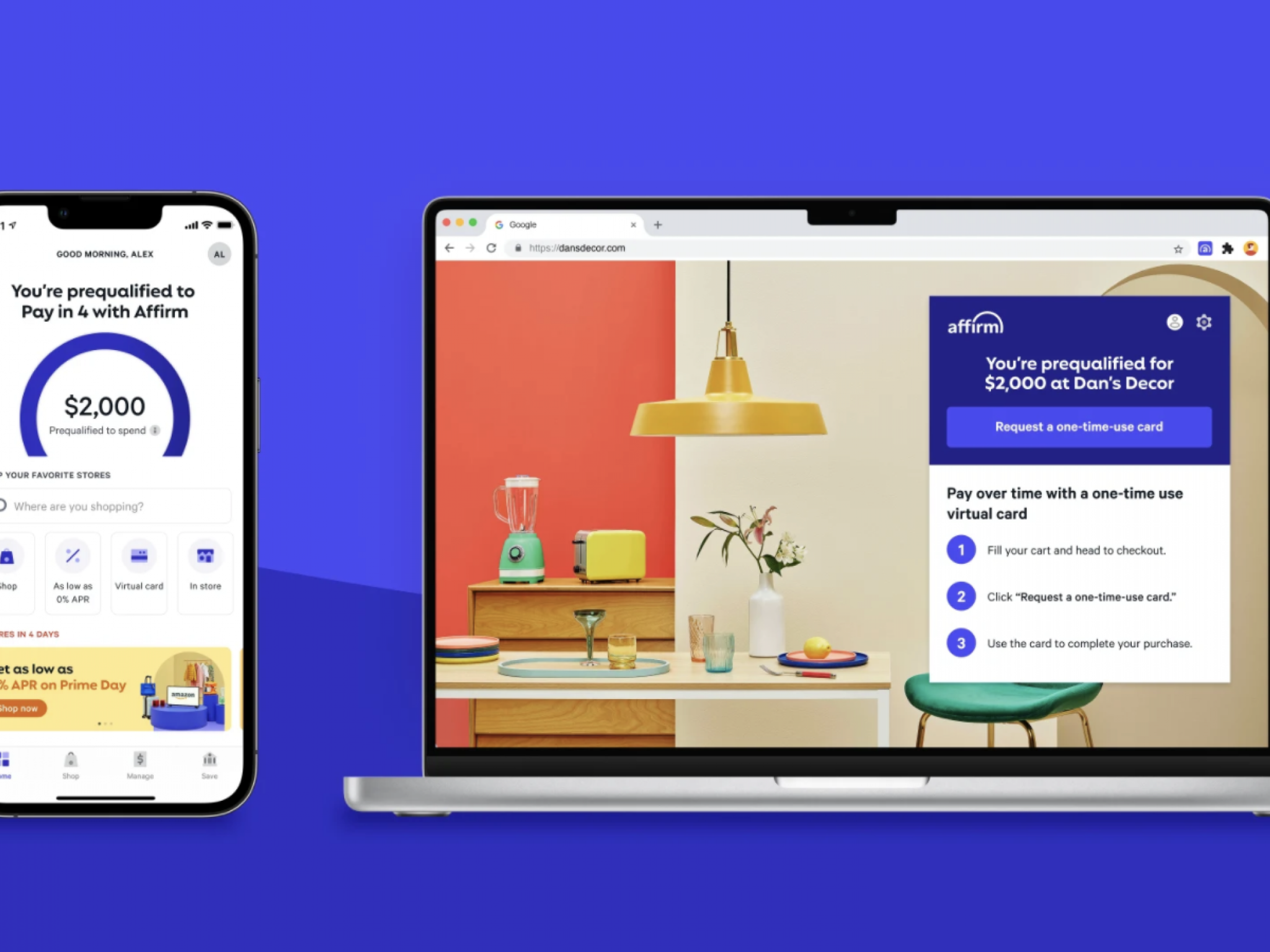

Photo: Courtesy of Affirm.