Nvidia (NVDA) shares extended declines in early Wednesday trading, pegging its one-week decline at around 8%, as investors exhibit a rare bit of caution on what Goldman Sachs has dubbed "the most important stock on planet earth" ahead of its hugely anticipated fourth-quarter earnings report.

Nvidia, which effectively fired the starting gun on the global AI technology race last spring when it forecasted huge gains in chip sales, will report both its January-quarter earnings update and near-term sales outlook after the close of trading.

Analysts expect Nvidia to post a bottom line of $4.64 per share, a more than fivefold increase from the year-earlier period, with revenue more than tripling (up 240%) to $20.62 billion.

Below is a quick cheat sheet for investors looking to track the market reaction after the earnings release and before the market opens on Thursday. It's based on five key metrics and challenges likely to be the focus of Wall Street.

TheStreet/Shutterstock/Slaven Vlasic/Stringer/Getty Images

1. Data-center sales

Nvidia will break its overall revenue tally into four major groups, but Wall Street will focus squarely on its data center segment, where the bulk of its artificial intelligence-related chip sales will be recognized.

Microsoft (MSFT) and Meta Platforms (META) are likely to comprise around a third of the overall data center sales total, which is forecast to rise nearly fourfold from a year earlier to $16.8 billion.

Looking into the current fiscal quarter, which ends in April, analysts expect data-center revenue to rise to around $18.4 billion, a fivefold leap from the year-earlier period, with a fiscal 2024 total of around $81.1 billion.

"We are laser-focused on what the trajectory of GPU orders and demand flow looks like from enterprises," said Wedbush analyst Dan Ives. "Nvidia and Microsoft are the first derivatives of the AI Revolution, with the second/third/fourth derivatives of AI now starting to form in this market, which speaks to our 2024 tech bull thesis playing out."

Related: Analysts unveil new Nvidia price targets as key earnings report looms

2. Profit margins

One of the key drivers to Nvidia's profit expansion story has been the rise in average selling prices of its benchmark H100 chips, which are highly coveted by cloud service providers, including hyperscalers, and are typically priced in the region of $30,000 to $40,000 per unit.

The newly launched H200, however, is priced at a 35% premium to the H100, with the GH200 likely to fetch a 50% premium. Both offer enhanced processing speeds.

Investors will look closely at commentary regarding the demand outlook for both those newly launched chips, with Amazon (AMZN) likely a key near-term driver.

Analysts see Nvidia's fourth-quarter gross margin coming in at around 74.45%, according to LSEG forecasts, compared with around 66.1% in the year-ago period.

Looking ahead, the Street sees gross margins widening modestly in the current quarter to 75.5% and holding at those levels until the end of the fiscal year.

Related: Nvidia's maiden 13F filing sends AI-focused tech stock soaring

3. Blackwell chip launch

Reports suggest Nvidia will launch the next-generation B100 Blackwell into its AI-focused lineup later this year, most likely at the group's Global Technology Conference in March. It is expected to add more heft to its second-half revenue prospects and ease some capacity issues tied to its H100 benchmark.

"While shorter new-product cadence is raising questions about the pace of customer adoption, we anticipate a rapid rollout of B100 instances by Public Cloud companies given the intense competition for all things AI," said Raymond James analyst Srini Pajjuri. The analyst carries a strong buy rating with an $850 price target on Nvidia stock.

Pricing will be key: analysts expect a 10% to 15% premium to the H200 chip, with ramps also likely to help with CoWoS capacity constraints.

Chip-on-wafer-on-substrate, or CoWoS, is a crucial component of AI-chip making and has been weighing on Nvidia deliveries for much of the past year.

Taiwan Semiconductor (TSM) , the world's biggest chip contractor, has struggled to meet the surge for its high-end stacking and packing technology, warning investors "that condition will continue probably to next year."

Commentary on both CoWoS delays and the Blackwell chip launch will be crucial for investors in determining Nvidia's ability to grow data-center revenue at the currently projected pace.

More AI Stocks:

- Analyst reveals new Broadcom stock price target tied to AI

- AI stock soars on new guidance (it's not Nvidia!)

- Big tech stocks are doubling down on AI

4. China restrictions

Nvidia warned last quarter that China sales, which comprise around 20% to 25% of total group revenue, would likely slow "significantly" over the January quarter. That's a result of new export restrictions put in place by the U.S. government, aimed at limiting Beijing's access to AI and other high-tech gear.

Reuters has reported that Nvidia had told customers it was delaying the launch of the H20 chip, one of three chips it's developing due to the enhanced export restrictions, until early this year.

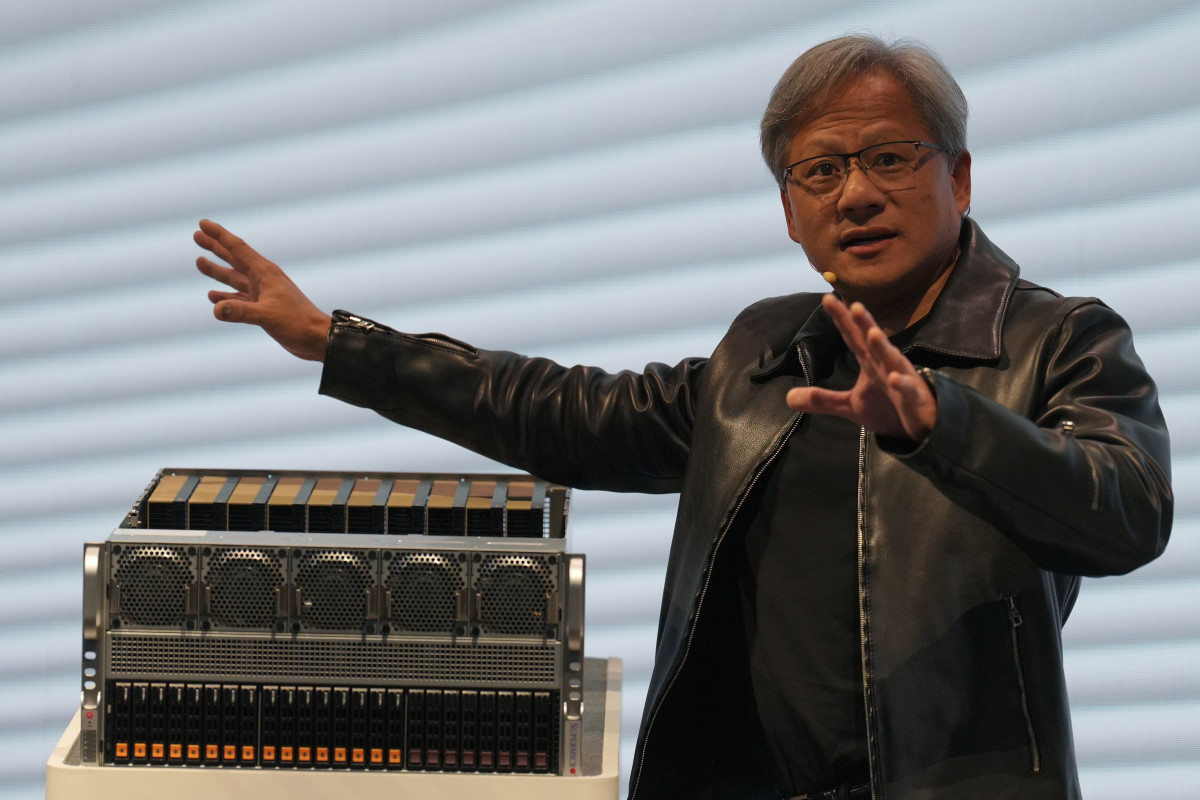

Speaking in Singapore during a conference on AI technologies in December, Chief Executive Jensen Huang said it was difficult to predict the revenue impact of the new U.S. restrictions on tech exports to China. But he added that it would nonetheless seek advice from customers and counsel from the U.S. government to tailor its semiconductors for sale in the $7 billion market.

Investors will be keen to hear details on the new H20 launch, as whether both the current China sales restrictions as well as the increasing rhetoric on tariffs from both U.S. presidential candidates will have a lasting impact on Nvidia's overall revenue growth.

Related: Nvidia stock is key to the Nasdaq making new record high

5. Revenue outlook

Nvidia shares have risen more than 45% this year and have added a staggering $680 billion in market value since October, largely on the prospects of its AI-chip sales.

That kind of performance, which has powered around a third of the Nasdaq 100's 6% gain, puts its near-term sales and profit outlook in sharp focus as investors look to justify their current holdings.

"Nvidia has had a great track record of exceeding Wall Street expectations, having beat revenue estimates every single time over the past two years," said Ken Mahoney, CEO at Mahoney Asset Management.

"However, the focus here really will be the guidance that could move the needle as the market is always discounting the future back to the present, and the rear view is not always as important," he added.

LSEG forecasts for overall April-quarter revenue currently sit at around $22.17 billion, with gains of around 6.8%, 15.7%, and 23.8% from that level expected over the following three quarters.

Goldman Sachs analyst Toshiya Hari, who added Nvidia stock to the investment bank's conviction-buy list last week, sees the potential for a 3% to 5% beat on both fourth-quarter revenue and the current-quarter outlook.

"We believe Nvidia will remain the industry gold standard for the foreseeable future given its robust hardware and software offerings and the pace at which it continues to innovate," Hari wrote.

Related: Veteran fund manager picks favorite stocks for 2024